In an era of digital transformation, organizations are constantly seeking innovative ways to enhance their financial management processes. One notable solution that has gained significant traction in recent years is the utilization of Linux, an open-source operating system, for the configuration of tax accounting systems. This strategic shift allows businesses to harness the power of flexible and secure software, enabling them to streamline their financial operations and optimize efficiency.

With Linux at the helm, financial professionals can leverage a myriad of robust tools and applications to facilitate tax accounting system configuration. The dynamic nature of Linux fosters seamless integration and compatibility with various software applications, enabling organizations to tailor their tax accounting systems to their specific needs. This freedom empowers businesses to make rapid and cost-effective adjustments without having to contend with vendor lock-ins or exorbitant licensing fees.

Furthermore, the inherent features of Linux, such as its stability, reliability, and unparalleled security, make it an extremely viable option for businesses in the realm of financial management. Employing Linux ensures data integrity and confidentiality, safeguarding sensitive financial information from potential cyber threats. The community-driven nature of Linux also ensures continuous system updates and patches, providing organizations with peace of mind as they navigate the intricate world of tax accounting.

Understanding the Power of Linux

Linux, widely recognized as a robust and versatile operating system, provides immense opportunities for businesses of all sizes. This section aims to explore the fundamental essence of Linux, shedding light on its unique features and capabilities without delving into the specific context of using it for tax accounting system configuration.

The Foundation of Open Source:

At its core, Linux is built upon the principles of open source software, which means that its source code is freely available for modification and distribution. This fosters a collaborative and transparent development environment, allowing users to contribute to its continuous improvement. The open-source nature of Linux promotes innovation, flexibility, and adaptability, making it a reliable choice for diverse computing needs.

The Power of Customization:

One of the key strengths of Linux is its ability to be customized to fit specific requirements. With its modular design philosophy, users can choose from a wide range of distributions, each tailored to different purposes and user preferences. This adaptability empowers businesses to configure their systems according to their unique needs, ensuring optimal performance and efficiency.

A Secure and Stable Environment:

Linux is renowned for its robust security features and stability. The distributed nature of its development model, coupled with a global community of experienced developers, results in rapid identification and resolution of vulnerabilities. Consequently, Linux-based systems are highly resilient to malware attacks and provide a secure platform for handling sensitive financial data.

An Extensive Software Ecosystem:

Linux enjoys a vast software ecosystem comprising thousands of open-source applications. From powerful accounting and financial software to comprehensive business management tools, Linux offers a wide array of options for businesses in diverse industries. This vibrant software ecosystem ensures that businesses can find and utilize the ideal software solutions for their tax accounting needs.

Embracing the Philosophy:

Linux is not merely an operating system but also a philosophy based on collaboration, transparency, and freedom. Its ethos aligns well with the principles of effective tax accounting, where accuracy, accountability, and integrity are paramount. By embracing Linux, businesses can integrate these values into their tax accounting system configuration, laying a strong foundation for efficient financial management.

Advantages of Linux in Tax Accounting

Linux operating system presents numerous benefits when it comes to tax accounting. This article highlights the advantages of embracing Linux for tax accounting purposes, showcasing its flexibility, security, cost-effectiveness, and reliability.

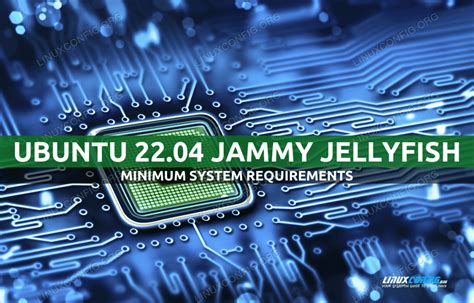

Minimum Requirements for Setting Up a Linux-Based Tax Accounting System

In order to successfully configure a tax accounting system on a Linux platform, certain system requirements must be met to ensure smooth operation and optimal performance. This article will outline the essential hardware and software prerequisites that should be considered when setting up a Linux-based tax accounting configuration.

Setting Up Linux for Efficient Financial Management

In this section, we will explore the process of installing and configuring a Linux operating system specifically tailored for the effective management of tax accounting tasks. By opting for Linux, individuals and organizations can streamline their financial operations and ensure seamless and secure tax compliance.

Firstly, we will delve into the installation process, which involves a series of steps to successfully set up Linux on your system. Discovering the right distribution that aligns with your requirements is crucial. In this article, we will highlight key considerations for selecting the optimal Linux distribution for your tax accounting needs.

Next, we will provide a comprehensive walkthrough of the installation process, outlining the necessary hardware and software prerequisites. Additionally, we will offer guidance on partitioning your hard drive to ensure the smooth functioning of your tax accounting system.

Moreover, we will delve into the post-installation steps that are essential for maximizing the efficiency and security of your Linux environment. This will include configuring user accounts, setting up network connectivity, and installing essential system updates.

Lastly, we will discuss best practices for optimizing your Linux system's performance. This will cover topics such as managing system resources, implementing data backups, and securing your tax accounting system against potential risks.

By following the guidelines presented in this section, you will be able to successfully install, configure, and optimize Linux for your tax accounting system, empowering you to streamline your financial management processes and enhance overall productivity.

Choosing the Appropriate Linux Distribution for Tax Accounting

When it comes to setting up a reliable and secure tax accounting system, selecting the right Linux distribution forms a crucial aspect to consider. The choice of Linux distribution can significantly impact the overall performance, stability, and security of the tax accounting system. This article aims to guide users in choosing the ideal Linux distribution by highlighting key factors to evaluate.

One of the primary considerations in the selection process is the compatibility of the Linux distribution with essential tax accounting software and tools. It is vital to ensure that the chosen distribution supports popular tax accounting applications seamlessly, allowing for smooth integration and efficient functionality.

Another critical factor to examine is the stability and reliability of the Linux distribution. Tax accounting involves handling sensitive financial data, and any system crashes or instability can lead to severe consequences. It is recommended to opt for a Linux distribution with a proven track record of stability, frequent security updates, and long-term support.

The security features offered by the Linux distribution should also be thoroughly assessed. Tax accounting systems deal with highly confidential information, and safeguarding it against potential cyber threats is imperative. The chosen Linux distribution should provide robust security mechanisms, including firewalls, intrusion detection systems, and encryption protocols.

Moreover, the user-friendliness and ease of management of the Linux distribution must not be overlooked. Efficient tax accounting requires a system that is easy to navigate and administer, even for individuals with limited technical expertise. Opting for a Linux distribution with an intuitive user interface, comprehensive documentation, and a supportive community can enhance user experience and simplify system management.

Lastly, the hardware compatibility of the Linux distribution with the existing infrastructure should be evaluated. Ensuring that the distribution supports the required hardware components and peripherals avoids compatibility issues and facilitates a smooth transition to the new tax accounting system.

| Factors | Description |

|---|---|

| Compatibility | Ensuring support for tax accounting software |

| Stability | Reliability and frequent security updates |

| Security | Robust security mechanisms |

| User-friendliness | Intuitive interface and ease of management |

| Hardware Compatibility | Support for existing infrastructure |

Setting up Tax Accounting Software on a Linux Environment

In this section, we will explore the process of configuring tax accounting software on a Linux operating system. We will discuss the necessary steps and procedures to effectively set up the software without relying on external systems or complicated configurations. By utilizing the robust features offered by Linux, we can ensure a secure and efficient tax accounting system.

To begin, it is essential to determine the specific tax accounting software that best suits your organization's needs. Consider the features and requirements of various software options available, ensuring compatibility with the Linux operating system. Once a suitable software is selected, we can proceed with the installation process.

The installation process typically involves downloading the software package from the official website or other authorized sources. It is crucial to verify the authenticity and integrity of the downloaded file to prevent any security breaches. Once the package is obtained, we can proceed with the installation by following the provided instructions.

During the installation, it may be necessary to configure certain parameters and settings specific to the tax accounting software. This includes providing necessary details such as company information, tax rates, and other relevant data. It is important to ensure accurate input to guarantee the accuracy of the tax accounting calculations and reports generated by the software.

Furthermore, it is recommended to regularly update the tax accounting software to benefit from the latest bug fixes, security patches, and improvements. This ensures the system remains up-to-date and capable of handling the evolving tax regulations and requirements.

Once the tax accounting software is successfully installed and configured, it is crucial to perform thorough testing and validation. This involves verifying the accuracy of calculations, generating sample reports, and ensuring seamless integration with other systems and processes within the organization.

In summary, the process of configuring tax accounting software on a Linux platform involves selecting a suitable software, downloading and installing the package, configuring necessary parameters, keeping the software up-to-date, and validating the functionality. By following these steps, organizations can effectively utilize Linux for their tax accounting requirements, ensuring accurate and efficient financial reporting.

| Advantages | Considerations |

|---|---|

| High level of security | Proper software compatibility |

| Efficient performance | Accurate parameter configuration |

| Regular updates and improvements | Thorough testing and validation |

Security Considerations for Implementing a Linux Solution for Tax Accounting System

In this section, we will delve into the critical aspect of securing your tax accounting system based on the powerful Linux platform. Developing a robust security framework is imperative to protect sensitive financial data and ensure regulatory compliance. We will discuss various considerations, strategies, and best practices to fortify the infrastructure and safeguard against potential threats and unauthorized access.

1. Authentication and Access Controls

Implementing secure authentication mechanisms and access controls is paramount to prevent unauthorized access and protect sensitive information. Robust passwords, two-factor authentication, and role-based access controls should be employed to ensure only authorized personnel can access the system. Regular audits and periodic password updates can further enhance security.

2. Encryption and Data Privacy

Data privacy is of utmost importance when dealing with tax-related information. Employing strong encryption algorithms and protocols for data transmission and storage will significantly mitigate the risk of data breaches. Ensuring that all confidential data is encrypted at rest and in transit helps to maintain the integrity and confidentiality of sensitive financial records.

3. Regular Software Updates and Patch Management

Keeping your tax accounting system up to date with the latest security patches and software updates is crucial to address vulnerabilities and protect against potential attacks. Establishing a robust patch management process ensures that security loopholes are patched promptly, reducing the risk of exploitation.

4. Network Security and Firewall Configuration

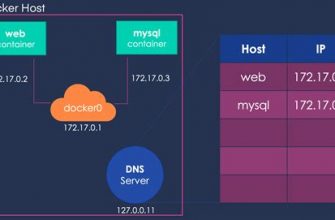

Configuring firewalls, setting up network segmentation, and implementing intrusion detection systems are essential steps towards network security. Segregating sensitive tax accounting components from the rest of the network and monitoring network traffic can help identify any suspicious activities and prevent unauthorized access attempts.

5. Employee Training and Awareness

Creating a culture of security awareness among employees is vital in maintaining the overall security posture. Regular training sessions to educate employees about phishing attacks, social engineering, and safe browsing practices can significantly reduce the likelihood of security breaches caused by human error.

Conclusion

By implementing a comprehensive security approach, including robust authentication mechanisms, data encryption, regular software updates, network security measures, and employee awareness programs, tax accounting systems built on the Linux platform can enhance data protection, mitigate potential risks, and comply with regulatory requirements.

Maintenance and Support for Configuring Tax Accounting on Linux Systems

In this section, we will explore the crucial aspects of maintaining and providing support for tax accounting configuration on Linux systems. Ensuring the smooth functioning and integrity of the tax accounting software and associated components is imperative for accurate financial reporting and compliance.

Within the realm of maintenance, regular updates and patches play a vital role in securing the system against vulnerabilities and ensuring compatibility with evolving tax regulations. We will delve into effective update management strategies, highlighting the significance of timely updates without disrupting day-to-day operations.

Furthermore, support is vital for addressing any technical issues or queries that may arise during the configuration process or while using the tax accounting system on Linux. We will discuss the importance of a dedicated support system that offers prompt and reliable assistance to avoid any disruptions in tax-related operations.

Additionally, proactive monitoring and performance optimization techniques will be explored to ensure the efficient execution of tax accounting tasks. By implementing appropriate monitoring tools and practices, potential bottlenecks can be identified and addressed, enhancing overall system performance.

Ultimately, this section aims to equip readers with the necessary understanding of the maintenance and support practices involved in configuring tax accounting systems on Linux. By implementing effective strategies and leveraging reliable support channels, companies can streamline their tax accounting processes and ensure compliance with regulatory requirements.

FAQ

What are the benefits of using Linux for tax accounting system configuration?

There are several benefits of using Linux for tax accounting system configuration. Firstly, Linux is known for its stability and security, which are crucial factors when dealing with sensitive financial data. Additionally, Linux provides a wide range of software options specifically designed for accounting purposes, offering flexibility and customization. Moreover, Linux is an open-source operating system, meaning it is cost-effective compared to proprietary software solutions. Lastly, Linux offers a strong community support, ensuring ongoing updates and bug fixes for the system.

Can I use Linux for tax accounting if I'm not familiar with the operating system?

Yes, you can use Linux for tax accounting even if you are not familiar with the operating system. Although Linux may have a learning curve if you are coming from a Windows or Mac background, there are user-friendly distributions available, such as Ubuntu or Linux Mint, that can simplify the transition. Additionally, there are plenty of online resources, tutorials, and forums where you can find guidance and help from the Linux community.

Are there any specific software programs available for tax accounting on Linux?

Yes, there are several software programs available for tax accounting on Linux. Some popular options include GNUCash, TurboCASH, and QuickBooks Online Edition. These programs offer features such as income and expense tracking, invoicing, tax calculations, and financial reporting. It's important to explore different software options and choose the one that best suits your specific tax accounting needs.

Will switching to Linux for tax accounting affect my current data and files?

Switching to Linux for tax accounting should not affect your current data and files if you properly migrate them to the new system. It is important to create backups of your data before making any changes and ensure compatibility between the file formats used by your current software and the ones supported by the tax accounting software you are planning to use on Linux. By following the recommended migration steps, you can smoothly transition to Linux without losing any important information.

Can I use Linux for tax accounting in a networked environment?

Absolutely, Linux can be used for tax accounting in a networked environment. Linux offers robust networking capabilities, allowing multiple users to access and work on the tax accounting system simultaneously. Additionally, Linux provides various network management tools, such as Samba or NFS, which enable seamless integration with Windows-based systems. It's important to ensure proper network configuration and security measures are in place to protect sensitive financial data when using Linux in a networked environment.