Unlocking the potential of a powerful operating system, harnessing the efficient functionalities of open-source software, and streamlining your financial processes are essential steps toward modernizing your accounting procedures. In today's rapidly evolving business landscape, staying ahead of the competition requires you to embrace innovative solutions that can revolutionize the way you manage your financial activities. This article delves into the intricacies of leveraging Linux, an operating system renowned for its stability and security, to establish a cutting-edge financial accounting framework.

Discover the endless possibilities that Linux offers, enabling you to construct a dynamic ecosystem tailored to your organization's unique requirements. By dismissing proprietary software restrictions, you gain the freedom to customize and optimize your financial accounting system to perfection. Linux's open-source nature empowers you to select a diverse range of applications and tools, allowing for seamless integration, scalability, and compatibility with various platforms.

Unleash the full potential of Linux as you embark on a transformational journey toward enhanced financial management. From simplified bookkeeping tasks to complex auditing capabilities, Linux provides a stable and secure environment to facilitate accurate financial reporting. Seamlessly navigate through intricate financial calculations while effortlessly generating comprehensive reports that align with the specific needs of your organization - all within a framework designed to safeguard your valuable financial data.

The Advantages of Linux in the Implementation of a Financial Management Solution

In today's fast-paced business environment, organizations are increasingly relying on advanced technology solutions to streamline their financial management processes. One such solution that has gained popularity is the use of Linux operating system for managing financial accounting operations. This section explores the various benefits and advantages that Linux offers in setting up a robust and efficient financial management system.

Firstly, Linux provides a secure and stable platform for financial accounting operations. With its strong security features and regular updates, Linux ensures the integrity and confidentiality of financial data, guarding against potential breaches and unauthorized access. The stability of the Linux system also minimizes the risk of system crashes or data loss, providing a reliable foundation for financial management tasks.

Furthermore, Linux offers versatility and flexibility in customization. With its open-source nature, organizations have the freedom to tailor the financial management system according to their specific requirements. This flexibility enables businesses to adapt and scale their accounting processes as they grow, ensuring that the system remains adaptable to changing business needs and industry trends.

Another significant advantage of Linux is its cost-effectiveness. Unlike proprietary operating systems, Linux is available as a free and open-source software, eliminating the need for expensive licensing fees. This affordability makes Linux an attractive option for organizations of all sizes, allowing them to allocate resources towards other critical areas of their financial workflows.

Moreover, Linux offers a wide range of compatible tools and applications that support financial management functions. From advanced accounting software to reporting and analysis tools, Linux provides a vast ecosystem of resources that can enhance and automate financial processes. By utilizing these tools, organizations can streamline their accounting operations, improve efficiency, and gain valuable insights into their financial performance.

In conclusion, the utilization of Linux in setting up a financial management system brings numerous benefits to organizations. With its security, stability, customization options, cost-effectiveness, and compatibility with various financial tools, Linux provides a solid foundation for businesses to efficiently manage their accounting processes and achieve financial success.

Enhanced Protection and Dependability

Evolution in Linux

Within the domain of financial record keeping and management, ensuring the reliability and security of data systems are paramount. With the ever-increasing dependence on technology, implementing a robust and stable operating system becomes indispensable. Linux, a powerful and flexible open-source platform, presents a compelling solution for establishing a secure and stable financial accounting system.

Improved Security Measures

The Linux operating system offers users a wide array of built-in security features to safeguard sensitive financial data. Its robust access controls, such as file permissions, authentication systems, and encryption algorithms, fortify the system against unauthorized access and data breaches. These security measures ensure that confidential financial information remains protected from external threats.

Stability for Uninterrupted Operations

Linux's stability, stemming from its strong code base and rigorous testing, guarantees a consistent and reliable computing environment for financial accounting purposes. Its exceptional ability to handle high workloads without compromising performance ensures the seamless execution of critical financial operations. Additionally, Linux's reputation as a resilient platform minimizes the risk of system failures, ensuring business continuity and peace of mind.

Community-Driven Updates

The thriving Linux community, comprising developers and users worldwide, consistently contributes to the improvement and security of the operating system. As vulnerabilities are identified and addressed promptly, Linux benefits from regular updates and patches, ensuring the system remains up-to-date and safeguarded against emerging threats. The collaborative nature of the Linux ecosystem fosters a collective effort towards a more secure and stable financial accounting environment.

Conclusion

By harnessing the enhanced security and stability inherent in Linux, organizations can establish and maintain a financial accounting system that is resilient against cyber threats, while providing a dependable foundation for the management of critical financial data.

Customizable and Open Source Software

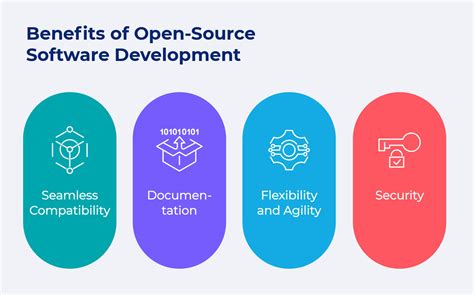

As businesses strive to optimize their financial processes and operations, the importance of customizable and open source software cannot be understated. This section explores the benefits of utilizing such software solutions, highlighting their adaptability and cost-effectiveness.

Customizable software allows businesses to tailor the functionality and features of their financial accounting system to meet their specific requirements. By providing a flexible framework, businesses can enhance their productivity and efficiency by incorporating personalized workflows, reporting mechanisms, and data analysis tools. This level of customization ensures that the financial accounting system aligns perfectly with the unique needs of the organization.

Open source software, on the other hand, offers businesses the advantage of transparency and community-driven development. With open source solutions, the source code is freely available, allowing organizations to modify and enhance the software as per their requirements. This fosters innovation and collaboration, as businesses can contribute to the ongoing development of the software and benefit from the improvements made by the community.

In addition to customization and openness, utilizing open source software provides significant cost savings compared to proprietary solutions. By eliminating licensing fees and vendor lock-in, businesses can allocate their financial resources more effectively. The availability of a vibrant ecosystem of open source software also ensures a wide range of compatible tools and extensions, further enhancing the functionality of the financial accounting system.

| Benefits of Customizable and Open Source Software: |

|---|

| 1. Tailored functionality and features |

| 2. Increased productivity and efficiency |

| 3. Transparency and community-driven development |

| 4. Cost savings compared to proprietary solutions |

| 5. Wide range of compatible tools and extensions |

Cost Savings and Reduced Expenses

The financial benefits of utilizing Linux for your accounting needs are significant and can lead to substantial cost savings and reduced expenses. By adopting Linux as your operating system, you open up opportunities for greater efficiency, improved security, and decreased reliance on expensive proprietary software.

One of the key advantages of Linux is its open-source nature, which means that the software is free to use, modify, and distribute. This eliminates the need for expensive licensing fees that are commonly associated with proprietary operating systems and accounting software. By leveraging Linux, businesses can allocate their budget towards other areas of financial management, such as investments, employee training, or expanding their operations.

In addition to cost savings, Linux offers robust security features that can help protect sensitive financial data. With Linux, you have the ability to customize the security settings to meet the specific needs of your accounting system, ensuring that your data is secure from unauthorized access or potential breaches. This reduces the risk of financial loss due to fraud or data theft, saving your organization from potential legal and reputational consequences.

Furthermore, Linux provides a stable and reliable platform for your accounting system, minimizing the occurrence of system crashes and downtime. This leads to increased productivity and efficiency, as employees can rely on a consistent and uninterrupted workflow. By eliminating costly system disruptions, businesses can optimize their operations and reduce the need for expensive IT support or maintenance.

In conclusion, by adopting Linux for your financial accounting needs, you open up opportunities for significant cost savings and reduced expenses. With its open-source nature, robust security features, and stable platform, Linux provides the foundation for an efficient and secure accounting system. Embracing Linux allows businesses to allocate financial resources towards growth and development while ensuring the integrity and security of their financial data.

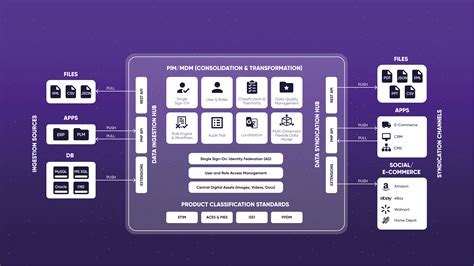

Seamless Integration with Other Business Applications

In today's rapidly evolving business landscape, the ability to seamlessly integrate various software applications has become essential for efficient financial management. This section explores the importance of integrating your financial accounting system with other business applications and highlights the benefits it brings.

Flexibility and Scalability

In the realm of financial management and data processing, the ability to adapt and grow is vital. This section explores the inherent flexibility and scalability offered by Linux for establishing a robust accounting framework.

Adaptability: Linux provides a dynamic environment that can be tailored to suit the diverse needs of financial accounting systems. Its open-source nature allows for customization and modification, ensuring that the software aligns with the unique requirements of any organization.

Expandability: With Linux, businesses can seamlessly expand their accounting capabilities as their operations grow. Its modular design allows for the addition of new features and functionalities without disrupting the existing system, ensuring a scalable solution that can accommodate evolving financial needs.

Interoperability: Linux offers compatibility with a wide range of software and hardware, enabling seamless integration with existing accounting tools. This cross-platform compatibility enhances efficiency and eliminates the need for costly system overhauls, making Linux a cost-effective and practical choice for financial accounting.

In summary, the flexibility and scalability of Linux empower organizations to adapt to changing financial landscapes and build scalable accounting systems that align with their unique needs and growth plans.

Efficient Data Management and Reporting

In today's rapidly evolving business landscape, effective data management and reporting are crucial for successful financial operations. This section explores strategies and techniques for optimizing data management processes, ensuring accurate financial information, and generating comprehensive reports.

One key aspect of efficient data management is the utilization of robust database systems. By leveraging powerful database technologies, businesses can store, organize, and retrieve financial data securely and efficiently. Additionally, implementing data normalization and indexing techniques can improve data integrity and retrieval speeds.

Furthermore, employing data validation and cleansing methods is essential to ensure the accuracy and reliability of financial information. These processes involve identifying and correcting errors, inconsistencies, and duplications in the data, ensuring the integrity of financial reports.

Effective reporting is another critical factor in financial accounting systems. By using advanced reporting tools and software, businesses can generate a wide range of reports, such as balance sheets, income statements, and cash flow statements. These reports provide valuable insights into the financial health of the organization and aid in decision-making processes.

Moreover, implementing automation in data management and reporting processes can significantly improve efficiency. By automating routine tasks, businesses can reduce manual errors, minimize processing time, and increase productivity.

Lastly, data security and compliance must not be overlooked in the realm of financial accounting systems. Implementing robust security measures, such as encryption and access controls, ensures that sensitive financial data remains protected from unauthorized access.

In summary, efficient data management and reporting are vital components in establishing a reliable and accurate financial accounting system. By utilizing robust database systems, employing data validation techniques, implementing automation, and prioritizing data security, businesses can enhance their financial operations and make informed decisions based on reliable financial information.

Simplified User Interface and Accessibility

The focus of this section is to highlight the emphasis placed on creating an intuitive and user-friendly interface for the financial accounting system, utilizing Linux as the operating system. With an eye towards accessibility, the design aims to provide a streamlined experience for users of varying levels of technical expertise.

Enhanced User Experience: The financial accounting system leverages Linux's vast array of open-source software tools to offer a simplified and intuitive interface. The user is provided with clear navigation paths and straightforward menus, ensuring ease of use and minimal learning curve.

Customizable Workspace: The system strives to meet the diverse needs of different users by allowing customization of the workspace. Users can organize and display relevant information in a way that suits their specific workflow, enhancing efficiency and productivity.

Accessible Design Principles: Consideration of accessibility is at the forefront of the system's development. The user interface adheres to accessibility standards, ensuring compatibility with assistive technologies and catering to users with disabilities. The design incorporates features such as keyboard shortcuts, high contrast options, and screen reader compatibility.

Visual Clarity and Consistency: The system's design emphasizes visual clarity and consistency, allowing for easy comprehension and navigation. The use of clear labels, standardized icons, and visual cues enables users to quickly understand the system's functions and features.

Intelligent Help and Support: An intelligent help system is embedded within the financial accounting system, providing contextual assistance and guiding users through various tasks. The system also offers comprehensive documentation and a robust support infrastructure to assist users in their day-to-day usage and problem-solving.

In conclusion, the simplified user interface and accessibility features of the financial accounting system assure an enhanced user experience, catering to users of varying expertise. The intuitive design, customizable workspace, adherence to accessibility standards, visual clarity, and intelligent help system contribute to an efficient and user-friendly financial accounting solution.

Reliable Support and Community Engagement

In the context of establishing and maintaining a comprehensive financial accounting solution, it is crucial to have access to reliable support and actively engage with a supportive community. This section explores the significance of reliable support and the benefits of community engagement.

When implementing a financial accounting system, it is inevitable that questions and issues will arise. Having reliable support ensures that users can seek assistance when confronted with challenges or uncertainties. A responsive support system offers prompt solutions and expertise to address any technical or operational hurdles.

Beyond timely support, community engagement plays a pivotal role in fostering knowledge sharing and continuous improvement. Being part of a community allows users to connect and collaborate with like-minded individuals who have similar interests, experiences, and goals. Through discussions, forums, and online resources, users can leverage the collective wisdom and learn from others' experiences.

Community engagement also opens up possibilities for discovering new tools, plugins, and customizations that can enhance the financial accounting system's functionality. By actively participating in the community, users can contribute their insights, ideas, and suggestions, ultimately influencing the evolution of the system and shaping its future development.

| Benefits of Reliable Support and Community Engagement |

|---|

| 1. Prompt resolution of technical and operational challenges. |

| 2. Access to expertise from support professionals. |

| 3. Knowledge sharing and learning from the community. |

| 4. Discovering new tools and customizations for system enhancement. |

| 5. Influencing the system's future development through active participation. |

Introduction to GnuCash - Free Accounting Software

Introduction to GnuCash - Free Accounting Software by Switched to Linux 89,132 views 4 years ago 20 minutes

How to automate Accounting Ledger, Trial Balance, Income Statement, Balance Sheet in Excel | English

How to automate Accounting Ledger, Trial Balance, Income Statement, Balance Sheet in Excel | English by EXCEL DOERS 1,051,995 views 10 months ago 1 hour, 3 minutes

FAQ

What are the advantages of using Linux for setting up a financial accounting system?

Using Linux for setting up a financial accounting system provides several advantages. Firstly, Linux is known for its stability and security, which are crucial for financial data management. Additionally, Linux is an open-source operating system, allowing for customization and flexibility to meet specific accounting requirements. Moreover, Linux provides a wide range of accounting software options specifically designed for financial tasks. Lastly, Linux is cost-effective as it does not require expensive licensing fees commonly associated with proprietary software.

Can Linux handle the complex calculations required for financial accounting?

Absolutely! Linux is fully capable of handling complex calculations required for financial accounting. Linux-based accounting software, such as GnuCash and ERPNext, have powerful features and robust mathematical algorithms to handle intricate financial calculations with accuracy and efficiency. These software solutions are developed and continuously improved by a dedicated community of developers, ensuring that they meet the demanding requirements of financial accounting.

Is it possible to integrate a Linux-based financial accounting system with other software used in the organization?

Yes, it is possible to integrate a Linux-based financial accounting system with other software used in the organization. Linux provides various tools and technologies for seamless integration, such as APIs and protocols like REST and SOAP. This allows for the exchange of data between different software systems, ensuring smooth workflow and eliminating the need for manual data entry. Furthermore, many Linux-based accounting software offer integrations with popular business applications like CRM systems or payroll software, enhancing overall organizational efficiency.

Are there any risks or challenges associated with using Linux for a financial accounting system?

While Linux is generally considered a reliable and secure platform, there can be some risks and challenges. One challenge is the learning curve associated with using Linux and its accounting software, particularly for those with limited experience or familiarity with the operating system. Additionally, finding Linux-specific support or assistance might be more challenging compared to widely-used proprietary software. Moreover, some proprietary software used in the financial industry may not have Linux-compatible versions, which could limit the options for integration. However, the benefits of Linux, such as its flexibility and cost-effectiveness, often outweigh these challenges for many organizations.

What are some popular Linux-based accounting software options available for setting up a financial accounting system?

There are several popular Linux-based accounting software options available for setting up a financial accounting system. Some widely-used choices include GnuCash, ERPNext, Odoo, and TurboCASH. GnuCash is an open-source accounting software with features like double-entry accounting and budget management. ERPNext is a comprehensive enterprise resource planning software that includes accounting modules. Odoo is a modular suite of business applications that offers accounting functionality along with other features such as CRM and inventory management. TurboCASH is another open-source accounting software designed for small businesses and nonprofits.

Can Linux be used to set up a financial accounting system?

Yes, Linux can be used to set up a financial accounting system. Linux provides a stable and secure platform for running accounting software. It offers a wide range of accounting software options, both free and commercial, that can be easily installed and configured on a Linux system.

What are the advantages of using Linux for financial accounting?

There are several advantages of using Linux for financial accounting. Firstly, Linux is known for its stability and reliability, ensuring that the accounting system will run smoothly without frequent crashes or errors. Secondly, Linux provides a highly secure environment, protecting sensitive financial data from potential threats. Thirdly, Linux offers a wide range of accounting software options, allowing businesses to choose the software that best fits their needs. Additionally, Linux is an open-source operating system, meaning it is often more cost-effective compared to proprietary operating systems.