In today's rapidly evolving business landscape, every organization, regardless of its size or industry, requires a robust and reliable accounting system to ensure financial stability and sustainability. As enterprises worldwide strive to streamline their financial operations, an increasing number of professionals are turning towards Linux, an open-source operating system renowned for its flexibility, security, and cost-effectiveness.

By harnessing the power of Linux, companies can unlock a realm of possibilities in establishing an accounting system that caters to their unique requirements and sets the stage for seamless financial management. With its vast array of customizable tools and applications, Linux offers an unparalleled level of control and adaptability, enabling businesses to tailor their financial processes to align perfectly with their organizational goals and strategies.

Embracing Linux as the foundation of an accounting system empowers businesses to break free from the limitations and complexities associated with traditional software solutions. The inherent stability and security of Linux provide a solid foundation upon which organizations can build a robust financial infrastructure, reducing the risk of system downtime, data breaches, and other potential setbacks that could impact the financial health of the organization.

Furthermore, utilizing Linux for establishing an accounting system not only enhances the overall efficiency of financial operations but also revolutionizes cost management. Unlike proprietary software that often comes with hefty licensing fees and recurring expenses, Linux offers a cost-effective alternative, eliminating the need for significant financial investments without compromising the system's functionality or performance.

This comprehensive guide unveils the unlimited potential and possibilities of leveraging Linux in building an accounting system that empowers organizations to achieve financial excellence and gain a competitive edge in today's dynamic business landscape. From exploring the intricacies of choosing the right Linux distribution to diving into the customization options and security enhancements, this guide equips financial professionals, IT specialists, and business owners with the knowledge and insights necessary to embark on a successful implementation journey.

Mastering Linux for Establishing an Accounting Infrastructure: A Thorough Walkthrough

Discovering the potential of Linux as a tool for setting up a robust and efficient accounting infrastructure can significantly enhance your financial management capabilities. By harnessing the power of this versatile operating system, you can establish a secure and flexible system tailored to meet your specific accounting needs.

Unleashing the Potential:

Begin your journey by exploring the myriad of possibilities that Linux offers for building an accounting system. Gain a deep understanding of the Linux environment, leveraging its extensive range of features, customizability, and compatibility with various accounting software solutions. Embrace the advantages Linux brings, such as enhanced security, stability, and cost-effectiveness, to establish an accounting infrastructure that aligns perfectly with your organization's goals and requirements.

Setting the Foundation:

Establishing a solid foundation is paramount when deploying Linux for your accounting system. Learn how to install and configure the Linux distribution that best suits your needs, ensuring compatibility with your chosen accounting software. Familiarize yourself with Linux package management to effortlessly install additional tools and libraries crucial for seamless integration with accounting applications. Emphasize the significance of system requirements and hardware optimization to guarantee optimal performance throughout your accounting operations.

Choosing the Right Accounting Software:

Selecting the ideal accounting software is vital for a successful implementation. Explore a variety of accounting software options compatible with Linux, examining their features, scalability, and user-friendliness. Gain insights into open-source solutions and proprietary software to make an informed decision based on your organization's size, complexity, and budget. Discover the process of installing and configuring the chosen accounting software within the Linux environment to ensure seamless interoperability and maximize efficiency.

Implementing Robust Security Measures:

Security is paramount when handling financial data. Learn how to fortify your Linux-based accounting system by implementing robust security measures. Explore methods for user and access management, ensuring sensitive data remains protected through authentication protocols and permission settings. Discover the importance of regular software updates and patch management to safeguard against potential vulnerabilities. Emphasize the significance of regular data backups and disaster recovery strategies to mitigate risks and ensure business continuity.

Efficient Utilization of Linux Tools:

Maximize the potential of Linux tools to optimize your accounting processes. Explore powerful command-line utilities and scripting capabilities to automate routine tasks, streamline data entry, and generate comprehensive financial reports. Discover the efficiency gains achieved through integration with existing productivity tools and databases, enhancing collaboration and minimizing data duplication. Unleash the potential of Linux's vast repository of accounting-related applications, enhancing your accounting system's capabilities and ultimately improving the overall financial management of your organization.

Continuous Improvement and Maintenance:

Evaluate your accounting infrastructure regularly to identify areas for improvement. Learn how to monitor system performance, identify bottlenecks, and apply optimizations that maximize efficiency. Stay up to date with the latest Linux and accounting software updates to ensure your system remains secure and benefits from new features. Develop robust maintenance practices, including routine backups, system health checks, and prompt issue resolution, to sustain the integrity and reliability of your Linux-based accounting system in the long term.

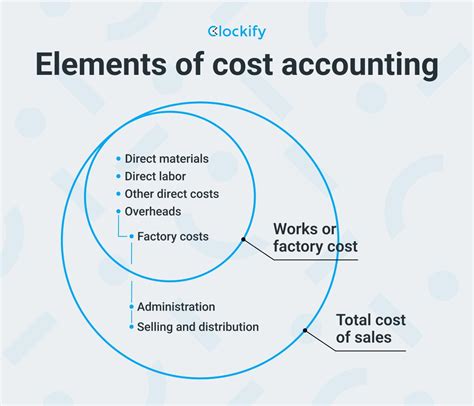

Advantages of Linux in Accounting

When it comes to implementing a robust and efficient accounting system, Linux offers numerous advantages that make it a preferred choice for many businesses. In this section, we will explore the unique benefits that Linux brings to the accounting landscape.

- Enhanced Security: Linux, known for its strong security measures, ensures that confidential financial data remains protected from unauthorized access and potential breaches.

- Cost-Effectiveness: Linux, being an open-source operating system, eliminates the need for costly licensing fees, resulting in significant cost savings for businesses.

- Stability and Reliability: With its rock-solid stability and reliability, Linux allows accounting systems to function seamlessly without frequent crashes or interruptions, ensuring that financial operations run smoothly.

- Flexibility and Customization: Linux provides businesses with the freedom to tailor their accounting system according to specific requirements, enabling the customization of functionalities and features as needed.

- Compatibility: Linux offers extensive compatibility with a wide range of accounting software applications, allowing businesses to leverage popular accounting tools and integrate them seamlessly into their Linux-based accounting system.

- Community Support: Linux benefits from a vibrant and helpful community of developers and users, providing reliable support and a wealth of resources to address any accounting-related challenges.

The advantages listed above highlight why Linux is a compelling choice for businesses looking to establish a robust and efficient accounting system. The combination of enhanced security, cost-effectiveness, stability, flexibility, compatibility, and community support make Linux an ideal platform for managing financial operations.

Choosing the Perfect Linux Distribution for Your Accounting Setup

When establishing an efficient and secure accounting system, it is crucial to select the most suitable Linux distribution for your business needs. The choice of the right Linux distribution can significantly impact the performance, security, and compatibility of your accounting setup. In this section, we will explore key considerations and factors to help you make an informed decision on the ideal Linux distribution for your accounting system.

First and foremost, it is necessary to evaluate the level of technical expertise available within your organization. Different Linux distributions cater to various levels of expertise, ranging from user-friendly options suitable for beginners to more advanced distributions designed for experienced Linux administrators. By understanding the skillset of your team, you can ensure smooth implementation and ongoing maintenance of your accounting system.

Another vital aspect to consider is the hardware requirements of each Linux distribution. Depending on the specific needs of your accounting system, such as the number of users, amount of data, and desired performance, different distributions may offer varying levels of compatibility and resource optimization. Evaluating the hardware requirements will help you choose a distribution that maximizes efficiency while minimizing costs.

Additionally, compatibility with accounting software is a crucial factor in the decision-making process. Ensure that the Linux distribution you choose supports popular accounting applications and tools commonly used in your industry. This compatibility will allow for seamless integration, efficient data management, and reliable performance, resulting in a streamlined accounting system.

Furthermore, it is essential to consider the level of community support and available documentation for a particular Linux distribution. Strong community support ensures access to a wealth of knowledge, resources, and troubleshooting assistance, which can be invaluable throughout the implementation and maintenance stages of your accounting system. Additionally, comprehensive documentation aids in understanding the distribution's features, configurations, and troubleshooting procedures.

Lastly, take into account the security features and updates offered by each Linux distribution. As accounting systems handle sensitive financial information, choosing a distribution with robust built-in security measures, regular updates, and a dedicated security team can significantly safeguard your data and protect against potential vulnerabilities.

By considering these factors and aligning them with your organization's specific requirements, you can confidently select the ideal Linux distribution for your accounting system. The choice you make will lay the foundation for a reliable, efficient, and secure financial management solution that supports your business's growth and success.

Installing Linux for Accounting: Step-by-Step Walkthrough

In this section, we will provide a detailed and thorough step-by-step guide on how to install Linux specifically tailored for setting up an efficient and reliable accounting system. The following instructions will aim to ensure a smooth and seamless installation process, enabling you to leverage the power and flexibility of Linux to streamline your accounting tasks.

Securing Your Linux-Based Accounting System

In this section, we will discuss the essential steps to configure the security settings for your Linux accounting infrastructure. Implementing robust security measures is crucial to safeguard your financial data and protect against unauthorized access or data breaches.

One of the primary considerations for securing your Linux accounting system is controlling user access. By properly setting up user accounts and permissions, you can limit who can access sensitive financial information and restrict their actions within the system. Additionally, it is important to regularly review and update user privileges to maintain the principle of least privilege and prevent unauthorized access.

Another vital aspect of securing your Linux accounting system is ensuring the confidentiality and integrity of your data. This can be achieved through encryption techniques, such as implementing appropriate encryption protocols for transmitting sensitive information over networks and encrypting data at rest. By encrypting data, you add an extra layer of protection to prevent unauthorized individuals from deciphering and accessing your financial data.

To further enhance the security of your Linux accounting system, it is important to regularly update the software and apply security patches. These updates often contain fixes for vulnerabilities that could be exploited by attackers. Establishing a regular patch management process ensures that your system is protected with the latest security measures and minimizes the risk of security breaches.

Additionally, strong password policies play a vital role in securing your Linux accounting system. By enforcing complex passwords that include a combination of uppercase and lowercase letters, numbers, and special characters, you can significantly reduce the risk of password guessing or brute-force attacks. It is also advisable to enforce regular password changes and implement multi-factor authentication for added security.

Lastly, setting up an effective logging and monitoring system is essential for detecting and responding to any suspicious activities or potential security threats. By implementing centralized logging and monitoring tools, you can review system logs, analyze user activities, and identify any abnormal behavior that may indicate a security incident. Regularly monitoring and reviewing these logs allows for timely response and mitigates any potential threats to your Linux accounting system.

| Key Steps for Configuring Security Settings: |

|---|

| 1. Control user access through proper account setup and permission management. |

| 2. Implement encryption techniques to secure data transmission and storage. |

| 3. Regularly update software and apply security patches to address vulnerabilities. |

| 4. Enforce strong password policies and consider multi-factor authentication. |

| 5. Establish a logging and monitoring system to detect and respond to security incidents. |

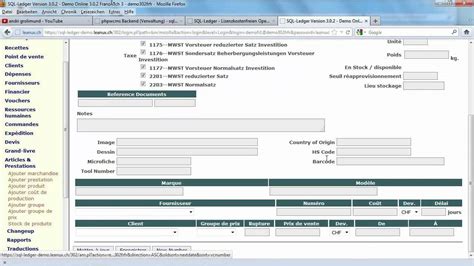

Setting Up Accounting Software on Linux

In this section, we will explore the process of installing and configuring accounting software on a Linux operating system. By utilizing the virtues of an open-source platform, Linux provides a robust and flexible foundation for managing your financial records and transactions.

First, we will discuss the various options available for accounting software on Linux, including both free and commercial solutions. We will examine the key features and functionalities of each software, ensuring that you choose the one that best suits your specific needs.

- Next, we will guide you through the installation process of the selected accounting software. This will include downloading the necessary packages, resolving any dependencies, and setting up the required environment variables.

- Once the software is successfully installed, we will demonstrate how to perform the initial configuration. This involves setting up user accounts, establishing the chart of accounts, and configuring tax settings, among other essential steps.

- Furthermore, we will explore the various customization options available within the accounting software. This will allow you to tailor the system to meet the unique requirements of your business or organization.

- We will also provide guidance on integration with other software and systems, such as point-of-sale systems, banking software, and payroll systems. This seamless integration enhances efficiency and accuracy in your accounting processes.

- Additionally, we will delve into the security aspect of your accounting software. We will cover essential practices to protect sensitive financial data, including implementing user access controls, encrypting data, and regularly backing up your records.

- Finally, we will provide troubleshooting tips and solutions for common issues that you may encounter while setting up and using accounting software on Linux. This will help you overcome any challenges and ensure smooth and uninterrupted operation.

By following this comprehensive guide, you will be well-equipped to leverage Linux for setting up a robust and efficient accounting system. With the right software and proper configuration, you can streamline your financial management processes and gain valuable insights into your business or organization's financial health.

Integrating Linux-based Accounting Solutions with Other Essential Business Software

In today's fast-paced business environment, it is crucial to have a seamless and efficient integration between the accounting system and other essential business tools. Linux, known for its flexibility and reliability, offers a robust platform for managing financial transactions and data. This article explores the various ways to integrate a Linux-based accounting system with other vital business software, enhancing productivity, accuracy, and collaboration across different departments.

Streamlining Financial Data Flow

One of the key advantages of integrating a Linux accounting system with other business tools is the ability to streamline the flow of financial data. By seamlessly connecting accounting software with project management systems, customer relationship management (CRM) software, and inventory management systems, businesses can ensure real-time information sharing and eliminate manual data entry tasks. This integration not only reduces human error but also provides accurate and up-to-date financial insights for better decision making.

Enhancing Collaboration and Communication

An integrated system allows for improved collaboration and communication between different teams within an organization. With Linux-based accounting solutions integrated with productivity tools like email, instant messaging, and document management systems, teams can easily share financial information, exchange invoices and receipts, and collaborate on financial reports. This seamless communication fosters better teamwork, efficiency, and transparency.

Automating Workflows and Processes

Integrating Linux accounting systems with other business tools enables organizations to automate workflows and processes, saving time and effort. By connecting accounting software with payroll systems, expense tracking tools, and tax management software, businesses can automate repetitive tasks, such as payroll processing, expense reimbursement, and tax filing. This automation not only reduces manual errors but also improves productivity and compliance with financial regulations.

Increasing Data Security and Integrity

Security and data integrity are paramount in any accounting system. Linux, being an open-source platform, provides robust security features that can be enhanced through integration with other business tools. By integrating accounting software with cybersecurity tools like firewalls, intrusion detection systems, and encryption mechanisms, businesses can ensure the confidentiality, integrity, and availability of financial data. This integration strengthens the overall security posture of the organization.

Unlocking Business Insights

The integration of Linux accounting systems with business intelligence (BI) and data analytics tools can unlock valuable insights hidden within financial data. By combining accounting data with sales data, customer data, and operational data, businesses can gain a holistic view of their financial performance and make data-driven decisions. This integration empowers organizations to identify trends, analyze financial patterns, and forecast business outcomes more accurately.

Overall, integrating a Linux accounting system with other business tools is essential for enhancing efficiency, accuracy, collaboration, and data security in managing financial operations. By harnessing the power of integration, businesses can optimize their accounting processes and gain valuable insights that drive growth and success.

Managing User Access and Permissions in Linux Accounting System

In this section, we will explore the essential aspects of managing user access and permissions within a Linux-based accounting system. Effective user management is crucial for the security and integrity of the accounting data, ensuring that only authorized individuals have access to sensitive financial information.

Controlling User Access: The first step in managing user access is to define user roles and responsibilities. By assigning appropriate access rights to each user or user group, you can ensure that they have access to the specific functionalities relevant to their job function. This helps to minimize the risk of unauthorized access or potential misuse of the accounting system.

Creating User Accounts: To establish user accounts, it is essential to follow a structured process. This typically involves creating unique usernames and strong passwords for each user. Additionally, implementing multi-factor authentication mechanisms can further enhance the security of user accounts, adding an extra layer of protection against unauthorized access.

Implementing User Permissions: User permissions dictate what actions a user can perform within the accounting system. By defining granular permissions, you can restrict certain activities such as modifying financial records, generating reports, or accessing sensitive financial data. It is crucial to review and update user permissions on a regular basis to align with any changes in job roles or responsibilities.

Auditing User Activities: To ensure accountability and traceability, it is necessary to implement user activity logging within the accounting system. By monitoring user activities, administrators can identify any suspicious or unauthorized actions and take appropriate measures to mitigate potential risks. Regularly reviewing audit logs can help identify patterns or anomalies that may indicate security breaches.

Password Management: Encouraging strong password practices is essential to protect user accounts and the overall security of the accounting system. This includes enforcing password complexity requirements, regularly prompting users to change their passwords, and prohibiting the reuse of previous passwords. Additionally, implementing password encryption techniques can further enhance the security of user credentials.

Revoking User Access: When an employee leaves the organization or changes their role, it is crucial to promptly revoke their access to the accounting system. This ensures that former employees cannot access financial data or perform any unauthorized actions. Implementing a robust user offboarding process helps maintain the integrity of the accounting system and prevent potential security breaches.

Conclusion: Effective user access and permissions management is a critical aspect of maintaining the security and integrity of a Linux-based accounting system. By controlling user access, creating user accounts, implementing user permissions, auditing user activities, managing passwords, and revoking user access when necessary, organizations can adequately protect their financial information and mitigate the risk of unauthorized access or misuse.

Troubleshooting Common Issues in Linux Accounting System

In the realm of Linux accounting system setup, it is imperative to be prepared for unexpected obstacles that may arise along the way. Despite the robustness and reliability of Linux, like any complex system, it is not immune to occasional glitches and hiccups.

This section aims to provide guidance on troubleshooting common issues that may occur during the setup and maintenance of a Linux accounting system. By understanding these potential challenges and the steps to resolve them, users can ensure smooth operation and accurate financial recordkeeping.

1. Resolving Network Connectivity Problems

One of the recurring issues in Linux accounting systems relates to network connectivity. Users may encounter difficulties in establishing connections between multiple devices or accessing remote servers. This section will outline troubleshooting steps and techniques to diagnose network issues and restore stable connections.

2. Addressing Software Compatibility Challenges

Another common stumbling block arises from software compatibility problems. As the Linux ecosystem offers a wide range of applications and packages, conflicts may occur when integrating different components of the accounting system. This section will discuss strategies to identify and resolve compatibility conflicts, ensuring the smooth operation of the accounting software.

3. Handling Disk Space Limitations

Disk space limitations can hinder the effectiveness of the accounting system, potentially impeding the storage and organization of financial data. This section will explore techniques to analyze disk space usage, identify areas of inefficiency, and propose solutions to optimize disk utilization, ensuring ample space for accounting processes.

4. Overcoming Security Vulnerabilities

The presence of security vulnerabilities poses a significant threat to the integrity and privacy of financial information. This section will outline common security challenges faced by Linux accounting systems and provide recommendations for mitigating risks, hardening defenses, and employing robust security measures.

By proactively addressing these common challenges, users can enhance the reliability and effectiveness of their Linux accounting system, providing a solid foundation for accurate financial management.

Best Practices for Maintaining a Linux Accounting System

In order to efficiently manage your accounting system on a Linux platform, it is essential to follow a set of best practices. These practices ensure the smooth operation, security, and accuracy of your financial records, without encountering any major hurdles or setbacks.

1. Regular Backup: Implementing a regular backup strategy for your Linux accounting system is crucial. This helps protect your data from accidental loss, system failures, or security breaches. Make sure to store backups on external or off-site storage devices to minimize the risks of data corruption or destruction.

2. Updated Software: Keeping your Linux accounting system up to date with the latest software versions is vital for maintaining security and stability. Regularly check for software updates, security patches, and bug fixes provided by the software vendors or the Linux distribution community.

3. User Access Control: Implement stringent user access control measures to restrict access to the accounting system only to authorized personnel. Assign individual user accounts with specific permissions and regularly review user privileges to prevent unauthorized access and potential data breaches.

4. Strong Password Policies: Enforce strong password policies to ensure the protection of sensitive financial information. Encourage the use of complex passwords, regular password changes, and the avoidance of using the same passwords across multiple accounts.

5. Secure Network Environment: Maintain a secure network environment for your Linux accounting system by implementing firewalls, intrusion detection systems, and regular security audits. These measures help protect your system from external threats and unauthorized access attempts.

6. Regular System Monitoring: Monitor your Linux accounting system regularly to identify and address any potential issues promptly. Utilize system monitoring tools to track system performance, resource utilization, and detect any anomalies that may indicate security breaches or system failures.

7. Documentation and Procedures: Properly document all procedures and actions related to your Linux accounting system. This includes installation steps, configurations, troubleshooting guides, and any customizations made. Accurate documentation serves as a valuable resource for future reference and ensures consistency in system maintenance and troubleshooting.

By following these best practices, you can effectively maintain your Linux accounting system, ensuring the integrity and security of your financial data. Remember that these practices should be regularly reviewed and updated to adapt to the evolving security threats and technological advancements in the Linux ecosystem.

[MOVIES] [/MOVIES] [/MOVIES_ENABLED]FAQ

What is Linux and why is it suitable for setting up an accounting system?

Linux is an open-source operating system that offers stability, security, and flexibility. It is particularly suitable for setting up an accounting system because it allows the user to customize and tailor the system to their specific needs, provides a wide range of accounting software options, and has a strong community support.

What are the advantages of using Linux for an accounting system over other operating systems?

Using Linux for an accounting system has several advantages over other operating systems. Firstly, it is a cost-effective solution as Linux is free to use, unlike proprietary operating systems. Secondly, Linux provides a higher level of security, which is crucial for managing sensitive financial data. Additionally, the open-source nature of Linux allows for easy customization and integration with other software tools.

Can I access my accounting system remotely if I use Linux?

Yes, you can access your accounting system remotely if you use Linux. Linux supports remote access protocols such as SSH (Secure Shell), which allows you to securely access and manage your accounting system from any location with an internet connection. This flexibility in accessing the system remotely is particularly beneficial for businesses with multiple branch offices or employees working remotely.

What are some popular accounting software options available for Linux?

There are several popular accounting software options available for Linux. Some of the widely used ones include GNUCash, which offers a user-friendly interface and comprehensive features for personal and small business accounting. Another popular choice is LedgerSMB, an ERP and accounting system designed for small to medium-sized businesses. Additionally, Odoo and InvoicePlane are also noteworthy options for managing accounting tasks on Linux.

Is it possible to migrate an existing accounting system to Linux?

Yes, it is possible to migrate an existing accounting system to Linux. However, the process of migration can vary depending on the specific accounting software being used and the complexity of the existing system. It is recommended to consult with a professional or seek guidance from the software provider to ensure a smooth and successful migration. Backing up the data and conducting thorough testing before the migration is also crucial to avoid any potential data loss or disruption.

Why should I use Linux for setting up an accounting system?

There are several reasons why Linux is an ideal choice for setting up an accounting system. Firstly, Linux is known for its stability and security, which are crucial factors when dealing with financial data. Additionally, Linux offers a wide range of accounting software options that are powerful and flexible. Furthermore, Linux is an open-source operating system, which means it is cost-effective and allows for customization and integration with other software systems.