Have you ever thought about fulfilling your aspirations, but felt that financial constraints were holding you back? Inevitably, many of us experience periods in our lives when we yearn to turn our dreams into reality, yet lack the necessary resources. Luckily, there exists a wide range of possibilities to bridge this gap and materialize your ambitions, with loans being one of the most prevalent and accessible options.

Loans provide individuals with the opportunity to obtain the funds required to advance personal or professional endeavors. Whether you aim to embark on a long-awaited vacation, invest in a new business venture, or even pursue higher education, borrowing money can serve as the stepping stone towards transforming visions into tangible achievements.

Nonetheless, navigating the realm of loans can be a complex and overwhelming endeavor, riddled with potential pitfalls and hidden complexities. With an abundance of lenders, loan types, and terms to choose from, it's crucial to equip yourself with comprehensive knowledge and guidance to make informed decisions. To aid you in this pursuit, we present the ultimate guide to borrowing money – an all-encompassing resource prepared to enlighten you on the intricacies of loan acquisition, ensuring you embark on your financial journey with confidence and clarity.

Throughout this guide, you will delve into the fundamental principles of borrowing, gaining insight into the various loan options available and the specific circumstances that may warrant their utilization. We will explore the key considerations lenders take into account when evaluating loan applications, equipping you with the know-how to present your financial profile in a favorable light. Additionally, we will illuminate the importance of credit scores, debt-to-income ratios, and the impact they carry on your borrowing potential. Armed with this knowledge, you will be able to position yourself strategically and optimize your chances of loan approval.

In our comprehensive coverage of loan types, we will peer into the realms of mortgages, personal loans, and business loans. With each category, we will delineate their distinct features, requirements, and potential benefits, while highlighting the factors to consider before embarking on each respective borrowing journey. Our guide will provide step-by-step instructions on loan application procedures, outlining the necessary documentation, timelines, and potential challenges you may encounter along the way.

Understanding the Fundamentals of Borrowing

In this section, we will delve into the essential concepts and principles of borrowing money. We will explore the mechanisms that govern lending and borrowing transactions, enabling you to gain a comprehensive understanding of this process.

- Loan Types: Discover the various types of loans available, such as personal loans, mortgages, or business loans. Understanding the differences between these loan types will help you make informed decisions.

- Interest Rates: Gain a grasp of the significance of interest rates and how they impact borrowing costs. Uncover the factors that influence interest rates and learn how to compare rates effectively.

- Collateral: Learn about collateral and its role in lending. Explore the concept of secured loans, where collateral is required, and the implications of defaulting on a loan with collateral.

- Credit Scores: Understand the importance of credit scores in borrowing money. Find out how credit scores are calculated and how they can affect your eligibility for loans and interest rates offered to you.

- Loan Terms: Explore the key aspects of loan terms, including the duration of the loan, repayment schedules, and any additional fees or penalties involved.

- Loan Application Process: Familiarize yourself with the loan application process, from gathering necessary documents to filling out forms and submitting applications. Understand the steps involved in the evaluation and approval process.

- Loan Repayment Strategies: Discover effective strategies for repaying your loans and managing your debt. Learn about different payment options and consider methods to minimize interest costs and accelerate debt repayment.

- Borrowing Responsibly: Explore the importance of responsible borrowing and financial planning. Understand the potential risks associated with borrowing and ways to ensure you borrow within your means and avoid excessive debt.

By understanding the basics of borrowing, you will be equipped with the knowledge necessary to make informed decisions when it comes to borrowing money. This section will provide you with a solid foundation to navigate the borrowing landscape confidently and responsibly.

Evaluating Your Financial Situation: Are You Ready to Seek Financing?

Before embarking on the journey to secure funding, it is essential to assess your current financial standing and determine if you are truly prepared to borrow money. Evaluating your financial situation allows you to gauge your ability to handle the responsibilities that come with borrowing and ensures that you make informed decisions.

To evaluate your financial readiness, it is crucial to analyze your income, expenses, and existing debts. Understanding your cash inflows and outflows will give you a clear picture of your financial health and help you determine if you can afford to take on additional debt. Consider creating a detailed budget that outlines your income sources and outlines your necessary expenses, such as rent/mortgage, utilities, and groceries.

- Assessing your credit score is another vital step in evaluating your financial situation. A good credit score is often a key determinant in securing favorable loan terms and interest rates. Obtain a copy of your credit report and review it carefully for any errors or inconsistencies that may affect your creditworthiness.

- Take stock of your savings and assets. Having a sufficient emergency fund and valuable assets can provide a safety net when seeking financing. Consider how much savings you have and if it will be enough to cover unexpected expenses or serve as collateral for a loan.

- Additionally, evaluate your existing debt load. Determine your current outstanding balances, interest rates, and monthly payments. Understanding your debt-to-income ratio will help you assess how much additional debt you can comfortably handle.

- It is also important to consider the purpose of the loan and whether it aligns with your financial goals. Evaluate if borrowing the money is a necessary and prudent decision or if there are alternative sources of funding available.

Evaluating your financial situation allows you to make an informed decision about borrowing money. It helps you understand your financial capabilities and limitations, enabling you to select the most suitable loan options and secure favorable terms. Remember, borrowing money should be a well-thought-out and responsible decision based on a thorough assessment of your financial readiness.

Exploring Different Types of Borrowing

When it comes to financing your dreams, there are numerous options to consider. In this section, we will explore various types of lending that can help you achieve your goals and aspirations. From traditional bank loans to alternative lending options, understanding the different types of borrowing can empower you to make informed decisions that suit your financial needs.

- Personal Loans: These loans are typically unsecured and can be used for a variety of purposes, such as debt consolidation, home improvements, or unexpected expenses. They offer fixed interest rates and monthly payments over a specific term.

- Mortgages: If you dream of owning your own home, a mortgage is the most common type of loan to make that dream a reality. Mortgages come in various forms, including fixed-rate, adjustable-rate, and government-backed options.

- Auto Loans: When purchasing a car, many individuals opt for an auto loan. These loans are specifically tailored for financing a vehicle and can be obtained from banks, credit unions, or dealerships.

- Student Loans: Education can often require significant financial investments. Student loans are designed to help individuals pay for their education, whether it be undergraduate or graduate studies. These loans typically come with various repayment options and interest rates.

- Business Loans: Entrepreneurs and small business owners often turn to business loans to fund their ventures. These loans can provide the necessary capital for starting a new business, expanding operations, or covering day-to-day expenses.

- Payday Loans: Payday loans are short-term loans that are typically repaid on the borrower's next payday. They are intended to provide immediate cash for unexpected emergencies or financial hardships.

By exploring the different types of borrowing available, you can determine which loan option aligns best with your specific needs and financial goals. Whether you are looking for flexibility, a low interest rate, or a quick solution, understanding the variety of loans at your disposal can help you make an informed decision and move towards achieving your dreams.

Choosing the Right Lender for Your Financial Needs: A Comprehensive Guide

When it comes to borrowing money, finding the right lender is crucial. Not all lenders are created equal, and selecting the most suitable one can greatly impact your financial well-being. This section aims to provide you with an in-depth understanding of the factors to consider when choosing a lender, enabling you to make an informed decision that best suits your specific needs.

First and foremost, it is essential to evaluate the lender's reputation. A reliable and trustworthy lender will have a solid track record of providing fair and transparent loans to borrowers. By researching reviews and feedback from previous customers, you can gain valuable insights into the lender's reliability and level of customer satisfaction.

Another vital aspect to consider is the range of loan options offered by the lender. Each individual has unique financial requirements, and a lender that offers a variety of loan products ensures that you can find one that aligns with your needs. Whether you require a personal loan, a business loan, or a mortgage, it is important to choose a lender with a diverse range of offerings.

Interest rates and fees are additional crucial factors to be mindful of while selecting a lender. Different lenders may offer various interest rates and fee structures, so it is essential to carefully review and compare these aspects. By doing so, you can secure a loan with the most favorable terms and conditions, ensuring that you can comfortably repay the borrowed funds without facing undue financial stress.

Flexibility is also an aspect that should not be overlooked. Life is unpredictable, and financial situations can change rapidly. A lender that offers flexible repayment options, such as the ability to adjust your monthly installment or make early repayments without penalties, can provide invaluable peace of mind and financial freedom.

Lastly, it is recommended to consider the level of customer service provided by the lender. A lender who prioritizes customer satisfaction and provides excellent support will ensure a smooth borrowing experience. Prompt communication, accessible customer support channels, and a willingness to address any queries or concerns are indications of a lender that values and respects its customers.

In conclusion, choosing the right lender is instrumental in ensuring a positive borrowing experience. By considering factors such as reputation, loan options, interest rates, flexibility, and customer service, you can make a well-informed decision that aligns with your financial goals. Remember, finding the right lender is not just about securing the funds you need, but also about establishing a trustworthy and ongoing financial partnership.

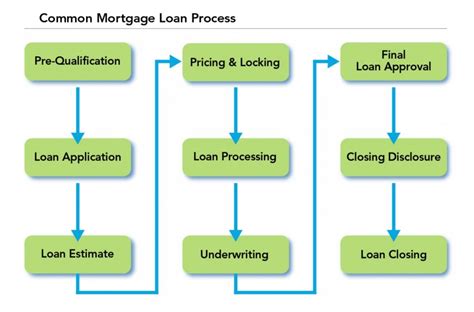

The Loan Application Process: Essential Information

In this section, we will explore the necessary steps and important details involved in the loan application process. Understanding these key aspects will empower you to navigate the application process with confidence and make informed decisions regarding borrowing funds.

1. Preparing your application:

Before applying for a loan, it is crucial to gather the necessary documents and information. This ensures a smoother and more efficient application process. Be prepared to provide personal details such as your identification, address, employment history, and income proof. Additionally, you may need to gather relevant financial documents or collateral information depending on the type of loan you are applying for.

2. Researching loan options:

Understanding the various loan options available to you is essential. Take the time to research and compare different lenders, interest rates, repayment terms, and associated fees. This will allow you to choose the loan that best fits your financial needs and repayment capabilities.

3. Completing the application:

Once you have gathered the required documentation and researched your options, it is time to complete the loan application. Ensure that you provide accurate and detailed information, as any errors or omissions can potentially delay or even disqualify your application. Take the time to review your application thoroughly before submission.

4. Waiting for approval:

After submitting your application, the lender will review the provided information and assess your eligibility for the loan. This process may involve verification of your employment, credit history, and overall financial health. It is important to be patient during this stage and avoid applying for multiple loans simultaneously, as this can negatively affect your credit score.

5. Loan approval and terms:

If your application is approved, the lender will provide you with the loan terms and conditions. This includes the approved loan amount, interest rate, repayment schedule, and any associated fees or penalties. Carefully review and understand these terms before accepting the loan offer.

6. Closing the loan:

Once you have accepted the loan offer, it is time to complete the necessary paperwork to finalize the loan agreement. This may involve signing legal documents and providing any additional information required by the lender. Upon completion, the funds will be disbursed to your designated account, and you can begin using the borrowed money according to your needs.

By familiarizing yourself with the loan application process, you can approach borrowing money with confidence and ensure a smooth and successful experience. Remember, always borrow responsibly and within your means to avoid unnecessary financial stress.

Tips for Enhancing Your Loan Eligibility

Facilitating the acquisition of a loan is a multifaceted process that hinges on various factors influencing an individual's eligibility. By paying heed to certain strategies and making informed choices, one can significantly enhance their chances of qualifying for a loan.

1. Focus on building a strong credit history: Lenders evaluate an applicant's creditworthiness based on their credit history. It is advisable to maintain a good credit score by making timely payments, minimizing outstanding debts, and avoiding any defaults or bankruptcies.

2. Reduce your debt-to-income ratio: Lenders assess an individual's ability to manage debt by analyzing their debt-to-income ratio, which compares their monthly debt obligations to their income. Lowering this ratio by paying off existing debts or increasing income can improve loan eligibility.

3. Maintain a stable employment history: Demonstrating a consistent work record with a steady income stream attracts lenders' confidence. Aim for job stability and avoid frequent job changes to present a reliable financial profile to prospective lenders.

4. Provide adequate collateral: To secure a loan, offering collateral that holds substantial value can enhance eligibility. Assets like property, vehicles, or any other valuable possessions can be considered as security, providing reassurance to lenders.

5. Research and compare lenders: Thoroughly researching and comparing various lending institutions and their offerings can help identify loan options that align with personal eligibility criteria. This enables borrowers to select lenders with favorable terms and conditions.

6. Ensure accurate and complete documentation: Submitting precise and comprehensive documentation is crucial to expedite the loan approval process. Verify that all necessary paperwork, financial statements, and identification proofs are prepared accurately to avoid any delays or rejections.

7. Seek professional guidance: Consulting with financial advisers or loan experts can provide valuable insights and guidance for improving loan eligibility. Their expertise ensures borrowers are well-informed and equipped to make informed decisions throughout the loan application process.

By implementing these tips while striving for loan eligibility, individuals can enhance their chances of successfully acquiring the desired financing to fulfill their personal or business aspirations.

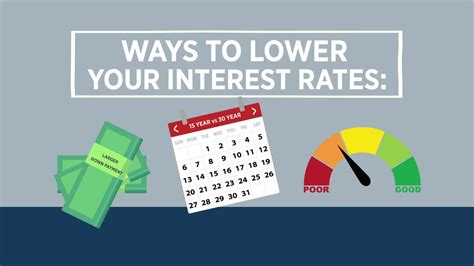

Understanding Interest Rates and Loan Terms

In this section, we will delve into the crucial aspects of interest rates and loan terms that every borrower should understand. Exploring these concepts will shed light on the financial implications and responsibilities associated with borrowing money.

1. Decoding Interest Rates

Interest rates form the backbone of any loan agreement, determining the cost of borrowing and the overall repayment amount. We will break down the various types of interest rates - fixed and variable - and discuss how they impact your monthly payments.

2. Grasping Loan Terms

Loan terms encompass the duration, repayment schedule, and any additional fees associated with the loan. Understanding these terms is essential for assessing the affordability of a loan and planning your financial commitments accordingly. We will explore key terms such as principal, maturity date, and amortization to help clarify the intricacies of borrowing.

3. Evaluating the Total Cost of Borrowing

Beyond the interest rates and loan terms, it is crucial to consider the comprehensive cost of borrowing. This includes potential origination fees, prepayment penalties, and other hidden costs. We will guide you through the process of evaluating the total cost of borrowing to ensure you are fully aware of the financial implications.

4. Factors Influencing Interest Rates

Interest rates are influenced by various factors, including market conditions, borrower's creditworthiness, inflation, and economic indicators. We will examine these factors in detail, helping you understand how they affect the interest rates offered by lenders and enabling you to make informed decisions.

5. Negotiating Loan Terms

Being familiar with interest rates and loan terms puts you in a stronger position to negotiate favorable loan conditions. In this section, we will provide tips and strategies for negotiating loan terms, empowering you to secure the best possible borrowing terms.

- Decoding Interest Rates

- Grasping Loan Terms

- Evaluating the Total Cost of Borrowing

- Factors Influencing Interest Rates

- Negotiating Loan Terms

By comprehending the intricacies of interest rates and loan terms, borrowers can make informed financial decisions that align with their goals and capabilities. With this knowledge, you can confidently navigate the borrowing process and achieve your financial objectives.

Effectively Managing Loan Repayments: Strategies for Success

In this section, we will explore various effective approaches to successfully manage your loan repayments. Repaying a loan requires careful planning and disciplined financial management to ensure a smooth and stress-free repayment process. We will discuss proven strategies that will help you stay on track with your loan payments, maintain a healthy credit score, and ultimately achieve your financial goals.

1. Develop a Reliable Budgeting Plan

One of the key strategies for managing loan repayments is to establish a reliable budgeting plan. This involves assessing your current income, expenses, and financial commitments to determine how much you can comfortably allocate towards loan repayments. By carefully analyzing your cash flow, you can prioritize your loan payments and eliminate any unnecessary expenses, enabling you to meet your repayment obligations consistently.

2. Automate Your Loan Repayments

To simplify the loan repayment process and avoid any chances of forgetting or missing a payment, consider setting up automatic payments. By automating your loan repayments, you can ensure that the required amount is deducted from your bank account on the specified due date each month. This not only saves you time and effort but also eliminates the risk of incurring late fees or damaging your credit history.

3. Explore Repayment Options and Strategies

Depending on the type of loan you have, there may be various repayment options and strategies available to you. For example, some loans offer flexible repayment plans, such as graduated repayment or income-driven repayment, which can be tailored to your financial situation. It is essential to understand these options and choose the one that suits your needs best, ensuring that you can comfortably manage your repayments throughout the loan term.

4. Prioritize High-Interest Debts

If you have multiple debts, it is crucial to prioritize their repayment based on their interest rates. Start by focusing on the debts with the highest interest rates to minimize the overall interest paid during the loan term. By targeting these high-interest debts first, you can save money in the long run and accelerate your progress towards becoming debt-free.

5. Communicate with Your Lender

If you are facing financial difficulties or anticipate challenges in meeting your loan repayments, it is important to communicate with your lender proactively. Many lenders offer assistance programs or flexibility options that can help you navigate through temporary financial setbacks. By discussing your situation openly, you may be able to negotiate an alternative payment plan or explore options such as deferment or forbearance.

By implementing these strategies and staying devoted to your repayment plan, you can take control of your loan repayments and achieve financial success. Remember, effective management of loan repayments not only ensures timely debt clearance but also enhances your overall financial well-being.

FAQ

What is the ultimate guide to borrowing money?

The ultimate guide to borrowing money is a comprehensive article that provides detailed information on various aspects of getting a loan. It covers topics such as different types of loans, eligibility criteria, loan application process, interest rates, loan repayment options, and tips for selecting the right loan for your needs.

What are the different types of loans available?

There are several types of loans available, including personal loans, student loans, car loans, home loans, and business loans. Personal loans are generally unsecured loans that can be used for any purpose, while student loans are specifically for educational expenses. Car loans are used to finance the purchase of a vehicle, and home loans are for buying or refinancing a home. Business loans, as the name suggests, are tailored for financing business ventures.

What are the eligibility criteria for getting a loan?

The eligibility criteria for getting a loan depend on the type of loan and the lender's requirements. Generally, lenders consider factors such as credit history, income stability, employment status, debt-to-income ratio, and collateral (in the case of secured loans). It's important to note that different lenders may have different eligibility criteria, so it's always advisable to check with the specific lender or financial institution for their requirements.

How can I improve my chances of loan approval?

To improve your chances of loan approval, there are several steps you can take. Firstly, maintain a good credit score by making timely payments and keeping your credit utilization low. Secondly, ensure a stable source of income and minimize your existing debts. It's also helpful to have a well-prepared loan application with all the required documents and a clear purpose for the loan. Finally, consider adding a co-signer or providing collateral to strengthen your loan application.

What should I consider before selecting a loan?

Before selecting a loan, it's important to consider several factors. Evaluate your financial situation and determine how much you really need to borrow. Compare interest rates and loan terms from different lenders to find the most favorable option. Consider the repayment period and monthly installments to ensure they fit comfortably within your budget. Additionally, take into account any fees, penalties, or additional charges associated with the loan. It's always advisable to read the fine print and fully understand the terms and conditions before committing to a loan.