Experience the convenience of modern banking with the prowess of cutting-edge technology. Step into a realm where seamless financial transactions become a reality, empowering you on your journey towards financial independence. Discover the art of digital transactions with the revolutionary SBPay iOS application.

Unleashing the power of your fingertips, the SBPay application allows you to effortlessly navigate through the realm of digital finance. With its intuitive interface and user-friendly design, managing your finances has never been easier. This innovative mobile application opens up a world of possibilities, providing you with a gateway to a more efficient and streamlined banking experience.

Embrace the future of banking as you unlock a myriad of features at your very fingertips. From bill payments to fund transfers, the SBPay app conquers the barriers of distance and time, offering you the freedom to manage your finances whenever and wherever you desire. With just a tap, you can now navigate the intricacies of digital transactions with ease and confidence.

Experience unrivaled security as you embark on your digital financial journey. The SBPay application boasts state-of-the-art encryption technology, protecting your sensitive data from prying eyes. Say goodbye to worries about fraudulent activities, as the app prioritizes your security while ensuring a seamless and efficient transaction experience. Strong authentication measures complemented by encrypted data transmissions give you the peace of mind you deserve.

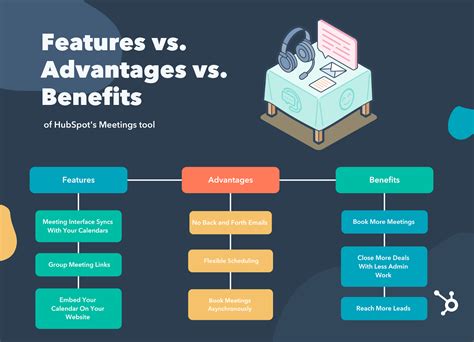

Exploring the Features and Advantages

Discovering the functionalities and advantages of the SBPay app allows users to fully optimize their mobile banking experience. By understanding the diverse range of features provided, users can make the most of the application's capabilities to simplify and enhance their financial management.

1. Real-time Transaction Monitoring Stay up-to-date with your finances by accessing real-time transaction updates. Tracking your expenses, income, and transfers becomes effortless and provides a clear overview of your financial status. | 2. Secure and Convenient Payments Experience the convenience of making secure payments with just a few taps on your mobile device. SBPay provides a secure platform that safeguards your personal and financial information and ensures hassle-free transactions. |

3. Budget and Expense Management Take control of your spending habits with SBPay's budget and expense management tools. Set personalized budgets, track your expenses, and receive notifications to help you stay within your financial plans. | 4. Seamless Account Integration Connect all your accounts effortlessly in one place. SBPay allows you to link your bank accounts, credit cards, and e-wallets, providing a comprehensive overview of your overall financial portfolio. |

5. Rewards and Loyalty Program Unlock exclusive rewards and benefits through SBPay's loyalty program. Earn points, receive cashbacks, and enjoy special offers when using the app for your transactions, further enhancing your overall banking experience. | 6. Quick and Easy Account Setup Get started on SBPay within minutes. The app offers a user-friendly interface that simplifies the account setup process, ensuring a seamless onboarding experience for both new and existing users. |

Understanding the features and benefits of SBPay empowers users to make informed decisions when it comes to managing their finances. Whether it's keeping track of transactions, securely making payments, managing budgets, integrating accounts, enjoying rewards, or setting up an account, SBPay delivers a comprehensive banking solution tailored to meet the needs of users.

Getting Started: A Beginner's Guide to SBPay on Your iPhone

Are you ready to explore the amazing world of mobile payments? With SBPay, the innovative app that brings convenience and security to your fingertips, you can now manage your transactions with ease. In this guide, we will walk you through the essential steps to get started with SBPay on your iPhone without overwhelming you with technical jargon.

Step 1: Getting the App

To begin your SBPay journey, the first step is to download and install the application on your iPhone. Simply head to the App Store and search for "SBPay." Once you find the app, tap on the "Install" button and wait for the download to complete. Keep in mind that a stable internet connection is required for this process.

Step 2: Setting Up Your Account

Once the SBPay app is successfully installed on your iPhone, it's time to set up your account. Launch the application and tap on the "Sign Up" button. Provide the required information, such as your name, email address, and a strong password. Make sure to choose a password that is easy for you to remember but difficult for others to guess. Remember, the security of your account is of utmost importance.

Note: If you already have an existing SBPay account, simply tap on "Log In" instead of "Sign Up" and enter your credentials to proceed.

Step 3: Adding Payment Methods

Now that you have your SBPay account set up, it's time to add your preferred payment methods. SBPay supports various options, including credit or debit cards and even digital wallets. To add a payment method, tap on the "Wallet" tab within the app and select "Add Payment Method." Follow the on-screen instructions to link your card or wallet to SBPay securely. Don't worry, your payment information will be encrypted to ensure maximum protection.

Step 4: Exploring Features and Settings

With everything set up, it's time to familiarize yourself with the features and settings of SBPay. The app offers a range of options, such as managing your transactions, setting spending limits, and customizing notifications. Take some time to navigate through the various tabs and submenus to discover how you can tailor SBPay to suit your preferences. Don't hesitate to explore all the available options – you'll be amazed at the convenience it brings to your everyday life.

Congratulations! You have now successfully embarked on your SBPay journey. Remember to always keep your app updated to enjoy the latest features and security enhancements. Happy mobile banking!

Step-by-step guide to download and install SBPay on your device

In this section, we will walk you through the process of acquiring and setting up the SBPay application on your mobile device. The following steps will assist you in obtaining the software and ensuring its proper installation for your convenience.

1. Acquiring the application:

To begin, you will need to locate the application's official download source. This can typically be done by visiting the app store relevant to your device's operating system, such as the Apple App Store or Google Play Store.

2. Search and locate SBPay:

Once you have accessed the app store, use the provided search functionality to look for SBPay. You may find it helpful to enter related keywords such as "SBPay mobile payment" or "SBPay finance app" to narrow down your search results.

3. Select and download the application:

Identify the official SBPay application from the search results and tap on it to access its dedicated page. Once there, review the application's details, ratings, and user reviews to ensure its suitability. To initiate the download, tap on the designated "Download" or "Get" button.

4. Installation process:

After the download is complete, locate the SBPay application on your device's home screen or designated application folder. Tap on its icon to commence the installation process.

5. Grant necessary permissions:

During installation, your device may prompt you with permission requests. These permissions allow SBPay to deliver its full functionality. It is essential to review these requests carefully and grant the necessary permissions for the application to operate optimally.

6. Set up your SBPay account:

Once the installation is finalized, launch the SBPay application. You will be guided through the account setup process, which typically involves providing relevant personal information, linking a payment method, and setting up any additional security measures, such as passcodes or biometric authentication.

7. Congratulations!:

After completing the account setup, you can explore and utilize the various features and functions of SBPay to enhance your financial management experience. Take some time to familiarize yourself with the application's interface and available options, ensuring a seamless and convenient usage going forward.

Setting up Your SBPay Account

When starting your journey with the SBPay mobile application, it is essential to set up your account to ensure a smooth and secure experience. This section will guide you through the process of creating and configuring your SBPay account, enabling you to make payments and manage your finances conveniently.

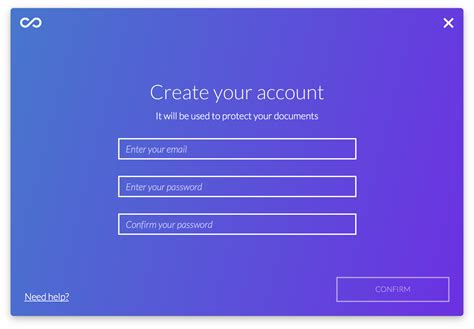

Step 1: Creating an Account

The first step in setting up your SBPay account is creating a new account. You will need to provide some basic information, such as your name, email address, and contact details. Additionally, you will need to choose a strong and unique password to protect your account from unauthorized access.

Step 2: Verifying Your Account

After creating your account, SBPay will send a verification email to the address you provided during registration. Click on the verification link in the email to confirm your account. This step ensures the security of your account and helps prevent fraudulent activities.

Step 3: Personalizing Your Profile

Personalizing your profile allows you to add more information about yourself and customize your account settings according to your preferences. You can upload a profile picture, specify your preferred language, and set up additional security features like two-factor authentication to enhance the protection of your account.

Step 4: Linking Your Payment Methods

In order to use SBPay for making payments, you need to link your preferred payment methods to your account. This can include adding credit or debit cards, connecting your bank account, or integrating alternative payment platforms. By linking your payment methods, you can easily manage and access your funds within the SBPay application.

Step 5: Exploring Additional Features

Beyond the basic account setup, SBPay offers various additional features that can enhance your mobile payment experience. Take the time to explore these features, including transaction history monitoring, budget tracking, and personalized offers. Familiarize yourself with the diverse capabilities of the SBPay application to optimize your financial management.

Conclusion

By following these steps, you can successfully set up your SBPay account and gain access to the wide range of features and benefits offered by the application. Take advantage of the convenience and security it provides, allowing you to make hassle-free payments and effectively manage your finances.

Creating a New Account or Accessing Your Account with Existing Credentials

When it comes to getting started with the SBPay mobile application, one of the first steps is to either create a new account or log in to your existing account using your credentials. This is a vital process that allows you to securely access and manage your financial information within the SBPay platform.

To create a new account, begin by selecting the "Sign Up" option on the app's home screen. You will be prompted to provide certain personal details such as your name, email address, and a password of your choice. It is important to select a strong and unique password to ensure the security of your account. After completing the registration form, review the provided information, and proceed to create your SBPay account.

If you already have an account, you can log in using your existing credentials. Simply click on the "Log In" option and enter your registered email address and password. Upon successful verification, you will gain access to your SBPay account, where you can manage your financial transactions, review transaction history, and perform various other activities.

It is essential to remember your login credentials and keep them confidential to prevent unauthorized access to your SBPay account. If you forget your password, you can select the "Forgot Password" option and follow the provided instructions to reset it and regain access to your account.

- Create a new account by providing personal details and selecting a strong password.

- Log in to your existing account using your registered email address and password.

- Keep your login credentials secure and confidential to protect your SBPay account.

- If you forget your password, follow the instructions to reset it and regain access to your account.

Exploring the User Interface

In this section, we will delve into the visual elements and interactive features of the SBPay application for iOS. By examining the user interface, we aim to provide a comprehensive understanding of how users can navigate and utilize the various functionalities offered by the app.

Visual Elements: The SBPay application integrates a visually appealing design, featuring intuitive icons, vibrant colors, and sleek typography. The interface is carefully crafted to enhance user experience, making it easy to locate and access different sections and actions within the application.

Navigation: The user interface incorporates a user-friendly navigation system that allows effortless movement between screens and sections. Through navigation menus, tabs, and swipe gestures, users can seamlessly explore various features and access relevant information without any confusion or hassle.

Interactive Features: SBPay app offers a range of interactive features to enhance user engagement and streamline transactions. Users can customize their account settings, view transaction history, make payments, and manage their finances through intuitive touch gestures and interactive elements.

Notifications and Alerts: The user interface includes a notification system that keeps users informed about important updates, account activity, and transaction confirmations. Through timely alerts and notifications, users can stay on top of their financial activities and respond promptly to any changes or actions required.

Accessibility: SBPay application is designed keeping accessibility in mind, ensuring that users of all abilities can use the app effectively. The user interface supports features such as voice commands and screen reader compatibility, allowing individuals with disabilities to navigate, interact, and perform transactions with ease.

Usability and User Experience: The combination of a visually appealing and user-friendly interface, seamless navigation, interactive features, and accessibility options makes SBPay a user-friendly and highly usable application. The user experience is optimized to provide convenience, efficiency, and satisfaction to users seeking secure and convenient mobile banking solutions.

By exploring the user interface of SBPay, users can unlock the full potential of the application and leverage its capabilities to manage their financial transactions effectively. With its visually appealing design, intuitive navigation, interactive features, and accessibility options, SBPay offers a seamless and enjoyable user experience in the realm of mobile banking.

Overview of the main screens and navigation menus

Introduction

Exploring the functionalities of the SBPay application involves navigating through several screens and menus. This section provides an overview of the main screens and navigation menus available, highlighting their key features and functions.

Home Screen

Upon launching the application, users are greeted with the intuitive Home Screen. This screen serves as a central hub for accessing various features and services offered by SBPay. It provides a quick overview of account balances, recent transactions, and important notifications.

Payment Screen

The Payment Screen allows users to initiate transactions and make payments seamlessly. Here, users can enter recipient details, specify the payment amount, and choose from a range of available payment methods. The screen also displays the transaction history and provides options for managing saved recipients and payment preferences.

Account Screen

The Account Screen offers a comprehensive view of the user's profile and account details. This screen empowers users to customize their preferences, update personal information, and manage security settings. It also provides access to additional functionalities such as generating account statements and setting up automatic payment reminders.

Settings Menu

Within the Settings Menu, users can fine-tune their SBPay experience according to their preferences. This menu encompasses options for customizing the application's appearance, managing notifications, and configuring security features. Users can also find support resources and contact information within this menu for any troubleshooting or inquiries.

Help and Support Screen

For any assistance or queries, users can access the Help and Support Screen. This screen serves as a comprehensive knowledge base, providing answers to common questions and offering step-by-step guides on various functionalities. Users can also reach out to the support team directly through the provided contact information.

Conclusion

By familiarizing themselves with the main screens and navigation menus in SBPay, users can navigate the application effortlessly and utilize its full potential. With intuitive interfaces and user-friendly features, SBPay aims to provide a seamless and convenient financial management experience.

Managing Your Payment Methods

In this section, we will explore how to add and manage different payment methods within the SBPay application, providing you with a convenient and secure way to make transactions.

One of the key features of SBPay is its ability to support multiple payment methods, allowing you to choose the option that suits you best. Whether it's adding your credit card, linking your bank account, or integrating with popular digital wallets, SBPay ensures a seamless experience for managing your finances.

To begin, you can easily add a new payment method by navigating to the "Payment Methods" section within the app. Here, you will find a user-friendly interface that guides you through the process step by step. Simply follow the prompts to enter the required details, such as card information or bank account numbers.

In addition to adding new payment methods, SBPay also offers extensive options for managing them. You can view all your added payment methods in a clear and organized manner, making it easy to locate and edit the necessary information. Whether you need to update your card expiration date, change your default payment method, or remove an old account, SBPay provides a hassle-free way to maintain your financial profiles.

Furthermore, SBPay ensures the security of your payment methods by implementing industry-standard encryption and data protection measures. Rest assured that your sensitive information is guarded against unauthorized access, giving you peace of mind when conducting transactions through the application.

In summary, by utilizing the "Payment Methods" feature of SBPay, you can conveniently add, manage, and secure various payment options within the application. With its user-friendly interface and robust security measures, SBPay offers a comprehensive solution for your financial needs.

| Benefits | Features |

|---|---|

| Convenience | Easy addition and management of payment methods |

| Flexibility | Support for multiple payment options |

| Security | Encryption and data protection measures |

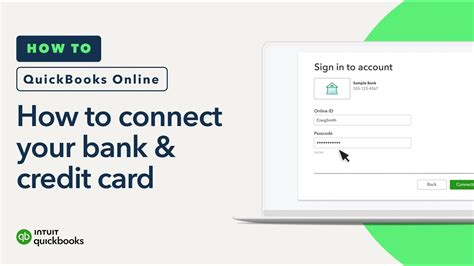

Connecting your banking or credit card details to SBPay

One of the essential steps in utilizing the functionalities of SBPay is linking your bank account or credit card to the application. By connecting your financial information, you gain the ability to seamlessly manage transactions, make payments, and enjoy the convenience of SBPay's features.

Before getting started, it is important to ensure the security of your sensitive data. SBPay takes privacy seriously, employing industry-standard encryption protocols to safeguard your information. Rest assured that your banking or credit card details are protected throughout the linking process.

To begin linking your account, open the SBPay application on your iOS device and navigate to the settings menu. Here, you will find the "Link Account" option, which allows you to establish a connection between your bank or credit card provider and SBPay. This step requires entering the necessary login credentials and authorizing SBPay to access your financial information.

Once the linking process is complete and your account is successfully connected, you can start enjoying the benefits of SBPay. With your bank account or credit card linked, you can make secure payments, track transactions, and efficiently manage your finances directly from the application.

Remember, it is crucial to keep your linked account details up to date. If you change banks or obtain a new credit card, make sure to update your information in the SBPay application to avoid any interruptions in your payment methods.

Linking your bank account or credit card to SBPay simplifies your financial management, offering a user-friendly experience and a range of convenient features. Take advantage of this seamless integration to optimize your payment and budgeting routines.

Making Payments via the SBPay Mobile App

In this section, we will explore the process of conducting transactions using the SBPay mobile application. We will delve into the various steps involved in making payments through this intuitive and user-friendly platform.

To initiate a payment, users can navigate through the app's seamless interface, accessing the payment feature effortlessly. Once the payment option is selected, users can then proceed to enter the desired payment amount. The app provides flexibility by allowing payments to be made in various currencies, catering to the diverse needs of its users.

Furthermore, SBPay understands the importance of security when it comes to financial transactions. To ensure a safe payment process, the app incorporates advanced encryption techniques, safeguarding sensitive user information. This gives users peace of mind, knowing that their financial details are protected.

| Step | Description |

|---|---|

| 1 | Enter recipient details |

| 2 | Review payment details |

| 3 | Authenticate using preferred security method |

| 4 | Confirm and authorize payment |

| 5 | Receive payment confirmation |

Once the payment details have been entered and verified, users are given the final opportunity to review and confirm the transaction. This step ensures accuracy and prevents any unintended errors in the payment process. Once the user provides their authorization, the payment is processed and completed.

Upon successful payment, users will receive a confirmation notification, providing them with the necessary documentation and proof of the transaction. This feature comes in handy for record-keeping purposes and offers transparency in financial transactions.

With its user-centric design and emphasis on security, the SBPay mobile app simplifies the payment experience, allowing users to effortlessly conduct transactions with confidence and convenience.

Sending Money to Friends or Making Purchases with SBPay

In this section, we will explore how you can effortlessly transfer money to your friends or make purchases using the SBPay app. Whether you need to split a dinner bill, pay your share of rent, or simply send a gift to a loved one, SBPay offers a seamless experience to meet your digital transaction needs.

Step 1: Once you have logged into your SBPay account, navigate to the "Send Money" or "Make Purchase" section, depending on your intended action. This section can typically be found in the main menu, conveniently accessible from the app's home screen. | Step 2: Enter the recipient's contact details or select them from your list of saved contacts. If the recipient is not already on your list, you can add them as a new contact by providing their relevant information. |

Step 3: Specify the amount you wish to send or the total cost of your purchase. SBPay allows you to input the amount manually or choose from predefined options based on common transaction values. Take a moment to review the transaction details to ensure accuracy. | Step 4: For sending money, you may have the option to include a personal message or note to accompany the transaction. This can help your friend identify the purpose or context of the transfer, making it more convenient for both parties involved. |

Step 5: Before confirming the transaction, double-check the recipient's details and the amount you have entered. Depending on the transaction type, you may also need to select your preferred payment method or input additional security information, such as a passcode or fingerprint authentication. | Step 6: Once you are satisfied with the provided information, click the "Send" or "Purchase" button to initiate the transaction. SBPay will process the transaction in real-time, allowing you to track its progress through the app's interface. You will receive a notification once the transaction is successfully completed. |

By following these simple steps, you can effortlessly send money to your friends or make purchases using the SBPay app's intuitive features. Whether you're settling debts, sharing expenses, or treating yourself to a well-deserved purchase, SBPay ensures a secure and user-friendly environment for all your transactions.

Managing Your Transactions

In this section, we will explore the various ways to effectively handle and oversee your financial activities within the SBPay application. By overseeing your transactions with precision and care, you can ensure a seamless and organized experience while using the app.

One of the key aspects of managing your transactions is keeping track of your income and expenses. By regularly monitoring and categorizing your financial activities, you can gain a comprehensive understanding of your spending patterns and make informed decisions about your budget.

Furthermore, the SBPay application provides you with the ability to view detailed transaction histories. By accessing this feature, you can easily track your purchases, payments, and transfers over a specified period. This helps you stay on top of your financial obligations and detect any discrepancies or unauthorized transactions.

In addition to monitoring your transactions, the SBPay application allows you to set up customized alerts and notifications. These alerts can be configured to notify you of specific events, such as when a transaction exceeds a certain amount or when a bill is due. By taking advantage of these features, you can proactively manage your finances and avoid any potential issues.

Another valuable feature offered by SBPay is the ability to generate reports and statements. These reports provide a comprehensive overview of your financial activities, allowing you to analyze your spending habits and make adjustments as needed. You can generate reports based on timeframes, categories, or specific criteria to gain deeper insights into your financial behavior.

In conclusion, effectively managing your transactions within the SBPay application enables you to stay organized, gain insights into your spending habits, and make informed financial decisions. By utilizing the various tools and features provided by the app, you can maintain control over your finances and achieve your financial goals.

[MOVIES] [/MOVIES] [/MOVIES_ENABLED]FAQ

What is SBPay iOS Application?

SBPay iOS Application is a mobile app that allows users to make secure and convenient payments using their iPhone or iPad. It is designed to provide a seamless and user-friendly experience for managing financial transactions.

How do I download and install SBPay iOS Application?

To download and install SBPay iOS Application, go to the App Store on your iPhone or iPad. Search for "SBPay" and tap on the "Install" button. Once the installation is complete, you can open the app and follow the on-screen instructions to set it up.

What payment options are available in SBPay iOS Application?

SBPay iOS Application supports a variety of payment options, including credit cards, debit cards, and mobile wallets such as Apple Pay. You can easily link your preferred payment method to the app and use it for making purchases or transferring money.

Is SBPay iOS Application safe to use?

Yes, SBPay iOS Application prioritizes user security and employs various measures to ensure the safety of your financial information. It uses encryption technology to protect your data and incorporates advanced authentication methods to prevent unauthorized access.

Can I track my transaction history in SBPay iOS Application?

Absolutely. SBPay iOS Application provides a transaction history feature that allows you to track and review all your past payments and transfers. You can easily access this information within the app and even generate detailed reports for your convenience.