If you are an avid user of your smartphone for managing your finances, one of the most convenient ways to access your banking services is through the use of mobile applications. These powerful tools allow you to effortlessly handle your transactions, check your balance, and stay updated on the latest financial information. However, obtaining and installing banking apps can often be accompanied by various challenges, especially if you are looking for alternatives to mainstream options. Fortunately, this article will guide you through the process of acquiring banking applications on your iPhone without relying on the commonly known app stores.

Embrace a Diverse Range of Solutions

When it comes to obtaining banking apps for your iPhone, it is essential to explore alternative avenues that offer a rich selection of applications beyond the well-known ones. By widening your search horizons, you will not only gain access to a broader range of banking applications, but also discover innovative options that might offer unique features tailored specifically to suit your needs. Furthermore, this approach allows you to take advantage of the versatility offered by non-conventional app stores, ensuring that you have a diverse and personalized selection of banking apps.

Revitalize Your Smartphone's Security Measures

Safeguarding your personal information is of utmost importance when dealing with banking applications. To ensure the security of your sensitive data and maintain the confidentiality of your financial transactions, it is crucial to implement robust security measures on your iPhone. Strengthen your device's defenses by using multi-factor authentication, encryption tools, and regularly updating your operating system. Taking these precautionary steps will not only protect your personal information from potential threats but also guarantee the smooth functioning of your chosen non-mainstream banking applications.

Ultimate Guide to Setting up Financial Apps on Your iPhone

When it comes to managing your finances, having banking apps on your iPhone can be incredibly convenient. Whether you want to check your account balance, transfer funds, or pay bills, these apps offer a convenient and secure way to handle your financial transactions. However, the process of installing banking apps on your iPhone may seem overwhelming at first. This comprehensive guide is designed to help you seamlessly set up and navigate through the installation process, ensuring that you have the right financial apps in place to meet your banking needs.

Step 1: Research and Choose the Right Apps

- Explore the App Store's vast selection of financial apps

- Read reviews and ratings to identify the most reliable and user-friendly options

- Consider the features and functionality offered by different apps

- Focus on apps that align with your specific banking needs

Step 2: Check System Requirements

- Ensure your iPhone meets the minimum system requirements for the chosen banking apps

- Take note of any specific iOS version or device compatibility requirements

Step 3: Download and Install the Apps

- Open the App Store on your iPhone

- Search for the chosen banking apps using relevant keywords

- Tap on the app from the search results

- Click on the "Get" or "Download" button to start the installation process

- Wait for the app to download and install on your device

Step 4: Set Up Your Accounts

- Launch the installed banking app

- Follow the on-screen instructions to create a new account or log in to your existing account

- Provide the necessary personal and banking information securely

- Set up any additional security features, such as Touch ID or a passcode

Step 5: Explore App Features

- Familiarize yourself with the various features and capabilities of the banking app

- Learn how to view account balances and transaction history

- Discover how to make transfers between accounts or to external recipients

- Understand the bill payment process within the app

- Explore any additional tools or features offered by the app

Step 6: Regularly Update the Apps

- Stay proactive by regularly checking for app updates in the App Store

- Install the latest updates to ensure optimal performance and security

By following this ultimate guide, you can confidently install and set up banking apps on your iPhone without any hassle. With these apps at your fingertips, managing your finances will become more convenient and efficient than ever before.

Advantages of Utilizing Banking Applications on Your iPhone

With the ever-evolving advancements in technology, banking has become more convenient and accessible than ever before. Banking applications designed specifically for iPhones offer numerous advantages and benefits to users.

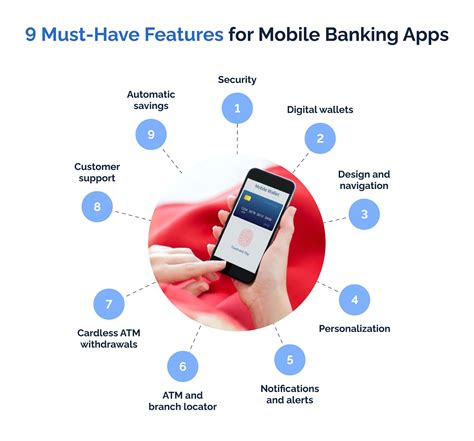

- Enhanced Security: Banking apps utilize advanced security protocols to ensure the safety of your financial data. Features such as biometric authentication and encryption technology provide an extra layer of protection against unauthorized access.

- Convenient Access: Having a banking app installed on your iPhone allows you to access your account at any time and from anywhere. Whether you need to check your balance, make transactions, or track your expenses, the app provides a seamless and user-friendly experience.

- Real-time Notifications: Banking apps send instant notifications about your account activity, including deposits, withdrawals, and suspicious transactions. This allows you to stay up-to-date with your financial situation and take immediate action if necessary.

- Time Efficiencies: By using banking apps, you can save a significant amount of time compared to traditional methods of banking. Tasks that previously required visiting a branch, waiting in queues, or completing paperwork can now be easily done with just a few taps on your iPhone.

- Budgeting and Financial Management: Many banking apps include features that assist in budgeting and financial management. You can set spending limits, categorize expenses, and receive insights into your spending habits to help you make informed financial decisions.

In conclusion, integrating banking applications into your iPhone enhances security, provides convenient access to your accounts, enables real-time notifications, saves time, and supports effective budgeting and financial management. Embracing these technological advancements can ultimately simplify and streamline your overall banking experience.

Ensuring Security: Best Practices

When it comes to safeguarding your digital transactions and personal information, implementing robust security measures is of utmost importance. By following best practices, you can significantly reduce the risk of unauthorized access and potential data breaches.

Here are some essential tips to ensure the security of your online banking experience:

1. Implement Strong and Unique Passwords: Creating strong and unique passwords for your banking accounts is vital. Avoid using common words, personal information, or sequences of numbers. Instead, opt for a mix of uppercase and lowercase letters, numbers, and special characters.

2. Enable Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring an additional verification method, such as a fingerprint, facial recognition, or a unique code sent to your registered device. Enable this feature whenever possible to prevent unauthorized access.

3. Keep Apps and Devices Updated: Regularly updating your mobile banking apps and devices is critical to ensure that you benefit from the latest security improvements and patches. These updates often address vulnerabilities that could be exploited by hackers.

4. Be Cautious of Phishing Attempts: Phishing attacks are common methods used by cybercriminals to trick individuals into revealing sensitive information. Be wary of suspicious emails, messages, or phone calls requesting your banking details, and only provide information through secure channels.

5. Install Security Software: Utilize reputable mobile security applications to protect your device from malware, viruses, and other malicious software. These applications can help identify and remove threats, enhancing your overall security.

6. Regularly Monitor Your Accounts: Keep a close eye on your banking transactions and statements. Promptly report any suspicious or unauthorized activities to your bank. Early detection can prevent further unauthorized access.

7. Use Secure Wi-Fi Networks: When accessing your banking apps, ensure that you're connected to a trusted Wi-Fi network. Public networks may lack proper security measures, making it easier for hackers to intercept your data.

By adhering to these security best practices, you can significantly enhance the protection of your online banking activities and mitigate the risks associated with cyber threats.

Choosing the Right Mobile Banking Application

When it comes to managing your finances on the go, finding the right mobile banking application is crucial. With a plethora of options available, it is important to carefully consider various factors before installing a banking app on your smartphone or tablet.

User Interface and Experience: An intuitive and user-friendly interface can greatly enhance your mobile banking experience. Look for an app that provides a clean and organized layout, easy navigation, and clear instructions. Consider selecting an app that offers a customizable dashboard, allowing you to personalize your banking experience.

Security Features: The security of your financial information is paramount. Look for a banking app that offers robust security measures, such as multi-factor authentication, encryption, and biometric login options. Additionally, ensure that the app follows industry-standard security protocols and has a track record of regularly updating its security features.

Functionality: Assess the functionality of the banking app in relation to your specific needs. Does it offer features such as balance inquiry, funds transfer, bill payment, and remote check deposit? Consider your banking habits and ensure that the app aligns with your requirements.

Compatibility: Check if the app is compatible with your mobile device's operating system version. Some banking apps may require the latest operating system updates, so ensure that your device meets the necessary requirements.

Reviews and Ratings: Reading reviews and checking the ratings of the app can provide valuable insights into the experiences of other users. Consider both positive and negative reviews to get a balanced perspective on the app's performance and functionality.

Support and Accessibility: Look for an app that provides reliable customer support and assistance. Consider whether the app offers 24/7 customer service and if there are multiple channels available for reaching out for help, such as phone, email, or live chat. Additionally, assess the accessibility features of the app, such as compatibility with assistive technologies or support for visually impaired users.

Terms and Conditions: Take the time to read and understand the terms and conditions of using the banking app. Pay attention to factors such as privacy policies, data sharing practices, and any associated fees or charges.

By carefully considering these factors, you can select a mobile banking app that meets your needs, provides a seamless user experience, and ensures the security of your financial information.

step-by-step Guide: setting up Banking Applications

Setting up banking applications on your mobile device can be a convenient way to manage your finances on the go. This step-by-step guide will walk you through the process of installing banking applications without the need for any third-party services or complex procedures. Follow these simple steps to securely set up and access your banking apps.

Step 1: Locate the app store on your device. Look for the icon that represents your device's official app store. This may be called "App Store", "Google Play Store", or something similar.

Step 2: Open the app store and search for your bank's official application. Use relevant keywords, such as the name of your bank, to find the correct application.

Step 3: Once you have found the correct application, tap on it to open the application's page. Look for the "Download" or "Get" button to initiate the download and installation process.

Step 4: The application will begin downloading and installing onto your device. Depending on your internet connection and the size of the application, this process may take a few moments.

Step 5: Once the installation is complete, locate the banking application on your device's home screen or app drawer. Tap on the application to open it.

Step 6: Follow the on-screen instructions provided by the application to set up your account. This may include entering your username, password, and any additional security measures.

Step 7: Once you have successfully set up your account, you will be able to access your banking app and begin managing your finances conveniently from your mobile device.

It's important to note that different banking apps may have slightly different installation processes or additional security measures. Always ensure that you are downloading and installing the official application from your bank to guarantee the security of your personal and financial information.

Troubleshooting Common Installation Issues

In this section, we will discuss some of the frequently encountered problems that users might face while attempting to set up and configure banking applications on their iOS devices. These issues can occur during the installation process, and cause inconvenience to users who are looking to access their banking services conveniently and securely.

One common issue is the inability to download the banking app from the App Store. Users might experience errors or the app might not show up in search results. This can be frustrating, especially when you have specific banking needs that require immediate attention. We will explore possible solutions for overcoming this issue, such as clearing the App Store cache or checking for software updates on your device.

Another problem users might encounter is the inability to log in to the banking app after installation. This can be due to a variety of reasons, including incorrect login credentials, server issues, or security settings on your device. We will provide step-by-step troubleshooting instructions to help you resolve these login issues and regain access to your banking app.

Sometimes, users may face compatibility issues with their iOS version and the banking app they wish to install. This can occur when the app requires a higher iOS version than the one currently installed on your device. We will guide you through the steps to check your iOS version and suggest alternative solutions such as contacting your bank for compatible versions or considering an upgrade for your device.

| Common Installation Issues | Possible Solutions |

|---|---|

| App not downloading from the App Store | Clear App Store cache, check for software updates |

| Authentication issues during login | Verify login credentials, check for server issues, review device security settings |

| Incompatibility with iOS version | Check iOS version, contact bank for compatible versions, consider device upgrade |

By addressing these common installation issues, you will be able to troubleshoot and resolve problems that might arise when installing banking apps on your iPhone without Aimezing.

Keeping Your Banking Apps Updated

Ensuring that your mobile banking experience remains secure and reliable is essential. One of the key steps to achieve this is by consistently updating your banking apps on your device.

Regular updates offer various benefits, including enhanced security measures, bug fixes, improved functionality, and the introduction of new features. Staying up to date with the latest versions of your banking apps helps to safeguard your financial information and provides a smooth user experience.

Here are a few tips to keep your banking apps updated:

- Enable automatic updates: Take advantage of the automatic update feature available in your device's settings. By enabling this option, your banking apps will be updated automatically whenever a new version is released.

- Check for updates manually: Periodically check for updates manually if you prefer to have more control over the update process. Open the App Store and navigate to the "Updates" tab to see if any updates are available for your banking apps.

- Read app update descriptions: Before installing updates, it is recommended to read the app update descriptions provided by the developers. This helps you understand the changes and improvements brought by the update.

- Download updates over secure networks: To ensure the security of your data while downloading updates, connect to a trusted and secure Wi-Fi network. Avoid downloading updates over public or unsecured networks as they could pose a risk to your personal information.

- Keep your device's operating system updated: In addition to updating your banking apps, it is equally important to keep your device's operating system up to date. Regularly check for system updates and install them to benefit from the latest security patches and improvements.

By following these steps, you can stay current with the latest versions of your banking apps and enjoy a safe and seamless banking experience on your device.

FAQ

Can I install banking apps on my iPhone without using Aimezing?

Yes, you can install banking apps on your iPhone without using Aimezing. There are other methods available to download and install these apps directly from the App Store.

Are there any risks involved in installing banking apps on an iPhone without Aimezing?

There are risks involved when installing banking apps from unofficial sources. It is always recommended to download banking apps directly from the App Store to ensure the safety and security of your personal and financial information.

What are the alternative methods to install banking apps on an iPhone?

There are several alternative methods to install banking apps on an iPhone. You can simply go to the App Store, search for the banking app you want, and install it directly. Alternatively, you can use the QR codes or download links provided by your bank to install their apps.

Why would someone choose to install banking apps on their iPhone without Aimezing?

There could be various reasons why someone may choose to install banking apps on their iPhone without using Aimezing. They may not be able to access Aimezing due to regional restrictions, or they may prefer to download the apps directly from the App Store for security reasons.