Managing your finances has never been easier, thanks to the seamless integration of cutting-edge technology with the banking sector. With the increasing popularity of mobile banking, it is crucial to have quick and secure access to your financial resources right at your fingertips.

Picture this: you have just upgraded to the latest model of the iconic smartphone, which offers a wealth of exciting features and enhanced capabilities. Now, you are eager to explore the world of banking apps that can be installed on your new device, giving you the power to handle your finances with utmost convenience.

In this article, we will guide you through the process of setting up banking applications on your brand-new iPhone. Whether you are an experienced iPhone user or a tech-savvy individual seeking to streamline your financial transactions, this step-by-step guide will help you navigate the world of mobile banking effortlessly.

By following our comprehensive instructions and recommendations, you will gain access to a wide range of banking apps, each offering unique features and innovative ways to manage your finances. Say goodbye to long queues at the bank or the hassle of logging into online banking platforms from your desktop. With the power of mobile banking on your new iPhone, you can carry your personal bank wherever you go and conveniently handle transactions with just a few taps on your screen.

A Foolproof Guide to Obtaining Banking Applications on Your Fresh Apple Device

In this section, we will guide you through the step-by-step process of acquiring and downloading financial applications onto your brand-new iPhone. Whether you wish to securely manage your finances, make transactions, or access your accounts on the go, these instructions will ensure an effortless experience.

Step 1: Explore the App Store

Begin by launching the Apple App Store on your iPhone and browsing through the vast selection of applications tailored for your banking needs. Utilize the search function or navigate through categories to find the most appropriate choices.

Step 2: Evaluate and Choose

Before proceeding with any application, it is essential to evaluate its features, user reviews, and ratings. Take advantage of the provided descriptions and screenshots to determine the suitability of the app for your personalized requirements. Once you find an application that meets your expectations, click on it to access additional details.

Step 3: Verify Compatibility

Prior to downloading an app, verify its compatibility with your iPhone model and operating system version. Ensure the application supports the specific requirements of your device to guarantee optimal performance and functionality. This information is typically mentioned in the app's description.

Step 4: Read Terms and Permissions

Before proceeding with the installation, thoroughly read the application's terms of service and privacy policies. Familiarize yourself with the permissions the app may require, such as access to your location or notifications. Make an informed decision based on your comfort level and considerations for data privacy.

Step 5: Download and Install

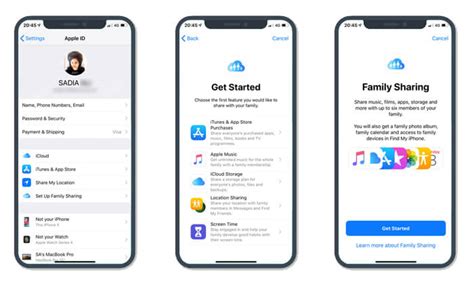

Once you have chosen the perfect banking application and understood its terms, click on the "Download" or "Get" button. Allow the application to install on your iPhone, and depending on your device's settings, enter your Apple ID or use Face ID/Touch ID for authentication.

Step 6: Set Up and Configure

After the installation is complete, locate the banking application on your home screen and open it. Follow the on-screen prompts to set up and configure the app, which may include providing necessary financial information, creating a secure PIN code, or linking your existing banking accounts.

Step 7: Explore and Enjoy

Once the initial setup is finalized, take a moment to familiarize yourself with the application's interface and features. Explore the different sections to manage your accounts, track transactions, pay bills, or access other financial services conveniently and securely, right from your shiny new iPhone.

Remember to ensure a reliable internet connection and sufficient storage space on your device before commencing the downloading process. Also, consider updating your iPhone's software regularly to enjoy the latest features and security enhancements.

Exploring App Store for Options to Manage Your Finances

When searching for ways to conveniently handle your financial matters using your shiny new smartphone, it's essential to explore the various applications available in the App Store. By scouting the App Store's vast selection of software options, you can discover a diverse range of cutting-edge solutions for effectively managing your monetary affairs.

Enabling you to find the perfect app tailored to your specific requirements, the App Store delivers an extensive assortment of banking applications, money management tools, and financial platforms. With each application offering distinct features and functionalities, your search process becomes an exciting exploration to find the ideal companion to oversee your financial well-being.

As you embark on this journey, it's crucial to utilize appropriate search queries that encapsulate your needs adequately. By employing relevant keywords such as "mobile banking," "financial planning," or "personal finance," you can narrow down your search to applications that align with your precise objectives.

Furthermore, don't forget to leverage the powerful reviews and ratings system provided within the App Store. By reading user feedback and assessing overall ratings, you gain valuable insights into the quality and reliability of each banking application. These user-generated opinions can help you make an informed decision, ensuring that you select an app that meets your expectations in terms of usability, security, and customer support.

Take advantage of the App Store's ability to sort applications based on various filters, such as popularity, release date, or relevance. This feature allows you to streamline your search process, quickly identifying the most promising options and facilitating an efficient evaluation of their suitability.

Once you've discovered a banking app that catches your eye, be sure to review its detailed description, paying close attention to its features, compatibility, and any additional requirements. Additionally, consider exploring screenshots and demo videos to gain a visual understanding of the app's interface and functionality.

Remember, the App Store continuously updates its selection, so periodically revisiting this vibrant marketplace may unveil new and innovative banking applications that can enhance your financial efficiency even further. So, embark on this exploration of the App Store, and discover the perfect banking app that will revolutionize how you manage your finances on your brand-new iPhone!

Choosing the Perfect Banking Application for Your Personal Requirements

When it comes to finding the ideal app to manage your financial transactions and banking needs on your new iPhone, it's essential to choose an application that aligns with your specific requirements and preferences. Selecting the right banking app can greatly enhance your overall user experience and provide you with access to a wide range of features and services tailored to your unique needs.

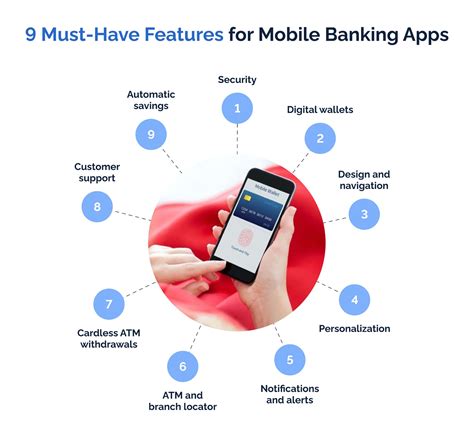

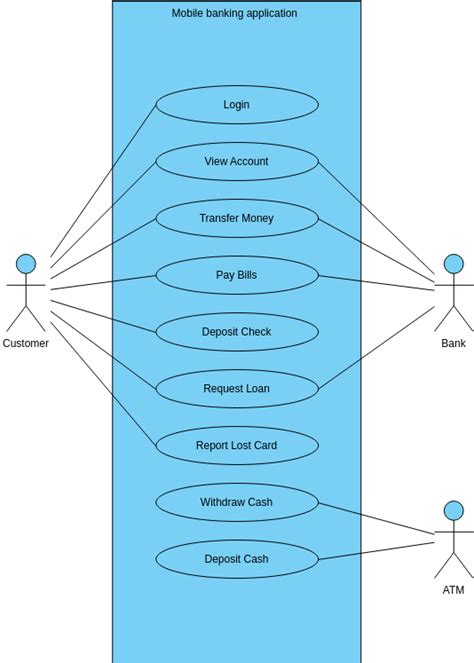

One of the crucial factors to consider is the app's user interface and overall ease of use. Look for an application that offers a clean and intuitive design, ensuring smooth navigation and hassle-free account management. A well-designed banking app facilitates efficient access to all the essential features, such as checking balances, transferring funds, paying bills, and monitoring your transactions.

Security should be an absolute priority when choosing a banking app. Ensure that the app you select utilizes robust security measures to protect your sensitive financial information. Look for features like two-factor authentication, encryption technology, and biometric login options to ensure your money and personal data are safe from unauthorized access.

Consider the additional features and services that the banking app offers. Some banking apps provide budgeting tools and financial management features to help you effectively track your spending, set savings goals, and analyze your financial habits. Others may offer features like mobile check deposit, ATM locator, or 24/7 customer support, which can significantly enhance your banking convenience.

It's also crucial to ensure compatibility with your bank or financial institution. Check if the banking app is associated with your preferred banking service provider and supports the necessary account types. Compatibility includes features like seamless integration with your existing accounts, real-time transaction updates, and effortless synchronization of data across devices.

Lastly, take into account the app's user reviews and ratings. Reading other users' experiences can provide valuable insights into the app's reliability, customer service, performance, and overall user satisfaction. Consider both the positive and negative reviews to gain a comprehensive understanding of the app's strengths and weaknesses.

By considering these factors and thoroughly researching various banking apps available for your new iPhone, you can ensure that you make an informed decision and choose the perfect app that meets your specific preferences and banking requirements.

Understanding the security features of mobile banking applications

In today's digital age, mobile banking applications have become increasingly popular for managing personal finances on-the-go. However, with convenience comes the need for robust security features to protect sensitive financial information from malicious activities. This section aims to provide an overview of the essential security measures implemented in mobile banking apps to ensure the safety and confidentiality of user data.

| Security Feature | Explanation |

|---|---|

| End-to-End Encryption | Mobile banking apps employ advanced encryption algorithms to secure all data transmitted between the user's device and the banking servers. This encryption ensures that even if intercepted, the data remains unreadable and incomprehensible to unauthorized individuals. |

| Two-Factor Authentication | Two-factor authentication adds an extra layer of security by requiring users to provide two different forms of identification, such as a password and a verification code sent to their registered mobile number or email address. This mechanism minimizes the risk of unauthorized access, even if the password gets compromised. |

| Biometric Authentication | Many banking apps offer biometric authentication options, such as fingerprint or facial recognition. These unique physiological features provide an additional level of security as they are difficult to replicate, ensuring that only authorized individuals can access the banking app. |

| Secure Session Management | Mobile banking apps employ secure session management techniques to protect user sessions from unauthorized access. This includes measures like automatically logging out users after a period of inactivity, requiring reauthentication for sensitive actions, and regularly refreshing session tokens to prevent session hijacking attempts. |

| Transaction Verification | Banking apps incorporate transaction verification mechanisms to allow users to review and authorize financial transactions before they are processed. This feature ensures that users have control over their funds and can detect any unauthorized transactions promptly. |

Understanding and utilizing these security features provided by mobile banking applications can help users make informed decisions about the safety of their financial transactions and safeguard their personal information from potential threats.

Setting up a secure login for your banking application

When it comes to accessing your financial information on your mobile device, it is crucial to set up a secure login for your banking application. This section will guide you through the process of establishing a strong login credential to protect your sensitive financial data.

One of the first steps in ensuring a secure login is creating a strong and unique password. Avoid using common phrases or easily guessable information such as your name or birthdate. Instead, opt for a combination of uppercase and lowercase letters, numbers, and special characters.

In addition to a strong password, enabling two-factor authentication is a highly recommended security measure. This involves linking your banking application to another trusted device or account, such as your phone number or email address. Whenever you log in, you will receive a unique code that needs to be entered, in addition to your password, adding an extra layer of protection.

Furthermore, it is important to regularly update your banking application and the operating system of your iPhone to ensure you have the latest security features and patches. Developers are constantly working to enhance the security of their apps, and updating regularly will help safeguard your financial information from potential vulnerabilities.

| Tip: | Keep your login credentials private and do not share them with anyone. Remember to log out of the banking app when finished, especially when using a shared or public device. |

|---|

By following these best practices and implementing robust security measures, you can have peace of mind while accessing your banking information on your new iPhone. Protecting your financial data is a top priority, and a secure login is the first step towards achieving that.

Granting necessary permissions to the banking app

In order to ensure smooth functionality and access to all features, it is vital to grant the necessary permissions to the banking app on your iPhone. These permissions allow the app to securely connect to your bank account, access relevant financial information, and provide you with a seamless banking experience.

Authorizing access to location data

One of the permissions that the banking app may require is access to your location data. This permission enables the app to provide you with personalized services based on your current location, such as locating the nearest bank branch or ATM. By granting access to location data, you can enjoy enhanced convenience and accessibility in managing your finances.

Granting permission to access contacts

Another permission that may be required is access to your contacts. This allows the banking app to facilitate easy transfers and payments to your contacts without the need for manual entry of their information. By granting permission to access contacts, you can save time and effort when initiating transactions with friends, family, or business associates.

Enabling push notifications

Enabling push notifications is another crucial permission that you should consider granting. This allows the banking app to send real-time alerts and updates regarding your account activity, such as transaction notifications, balance reminders, or security alerts. By receiving push notifications, you can stay informed about important financial events and take immediate action if necessary.

Granting access to biometric authentication

Many banking apps now offer the option of biometric authentication, such as fingerprint or face recognition, for enhanced security and convenience. Granting permission to access biometric data allows you to conveniently and securely log in to the app and authorize various transactions without the need for complex passwords or PINs. It provides an additional layer of protection for your sensitive financial information.

Managing permissions

It is important to note that you have control over these permissions and can manage them as per your preference. You can review and adjust the app's permissions at any time through your iPhone's settings. Keep in mind that granting necessary permissions ensures the smooth functioning of the banking app and allows you to maximize the benefits it offers in managing your finances.

Managing multiple financial applications on a brand-new iOS device

Once you have successfully set up and customized your new iPhone, it's time to explore the world of mobile banking by installing various financial apps. With the increasing number of financial institutions providing their own apps, it can be quite challenging to keep track of and manage multiple banking applications efficiently. This section aims to guide you on how to effectively manage and organize your collection of financial apps on your new iPhone.

| Step | Action |

|---|---|

| 1 | Organizing your home screen |

| 2 | Grouping apps using folders |

| 3 | Customizing app notifications |

| 4 | Enabling quick access features |

| 5 | Managing app updates and maintenance |

| 6 | Tips for enhancing app security |

By implementing these strategies, you can seamlessly navigate and switch between different banking applications, ensuring easy access and improved overall management. Be proactive in keeping your financial apps updated, organize them in a way that suits your needs, and utilize the customization options available on your new iOS device to optimize your mobile banking experience.

FAQ

Can I install banking apps on my new iPhone?

Yes, you can easily install banking apps on your new iPhone. The process is quite simple.

Where can I find banking apps for my iPhone?

You can find banking apps on the App Store. Simply open the App Store on your iPhone and search for your bank's app. Alternatively, you can visit your bank's official website or contact their customer support for guidance.

Is it safe to install banking apps on my iPhone?

Installing banking apps on your iPhone is generally safe, as long as you download them from official sources like the App Store. However, it is important to take necessary precautions, such as choosing a strong password, enabling two-factor authentication, and regularly updating the app to ensure security.

What information will I need to install a banking app on my new iPhone?

To install a banking app on your new iPhone, you will typically need your banking credentials, such as your username and password. Some banks may also require additional verification steps, such as OTP (one-time password) or biometric authentication (like Touch ID or Face ID) to ensure the security of your account.