When we envision the future, our minds often wander towards the realms of achievement, growth, and substantial wealth. It is within this expansive landscape that dreams materialize into astonishing realities, where aspirations are transformed into tangible assets. In the modern era, one emblematic representation of such accomplishments is found within the fabric of our monetary system, where strong currencies and cherished documents shape the way we perceive value and navigate our daily lives.

As our ambitions soar high, so too does the desired magnitude of our financial success. Within the vast realm of transactions and economic endeavors, the significance of currency emerges as a pivotal instrument in these ventures. It serves as a conduit through which dreams become realities, empowering individuals to explore new territories, forge prosperous paths, and create a vibrant tapestry of possibilities.

Yet, beyond the mere concept of paper money lies a deeper understanding of the valuable documents that govern its existence. These documents, often adorned with intricate designs and security features, bear witness to the authority and authenticity of the currency they represent. They become symbols of trust, carrying with them the weight of nations and the intricate mechanisms that uphold our economic systems.

From Origins to Modernity: The Fascinating Journey of Paper Currency

The story of paper money is an extraordinary journey that stretches back through centuries of human civilization. It encompasses the evolution of financial systems, the rise and fall of empires, and the fascinating ingenuity of mankind. This section explores the origins and development of paper currency, showcasing its historical significance and the transformative impact it has had on economies worldwide.

- Ancient Beginnings: Paper money, in its earliest forms, originated in ancient China during the Tang Dynasty. Utilizing the innovative concept of representing value on paper, this early form of currency had a profound influence on trade and commerce.

- European Innovations: As societies across the globe evolved, paper money found its way to Europe. The use of "promissory notes" emerged during the Renaissance, allowing merchants and bankers to establish credit and facilitate transactions across borders.

- The Birth of National Currencies: The seventeenth and eighteenth centuries saw the birth of national currencies, as governments began to issue paper money as a means of asserting control over their economies. This development marked a significant turning point in the history of paper currency.

- Revolutionary Figures: The American Revolution and French Revolution played pivotal roles in shaping the trajectory of paper money. Emerging nations sought to establish their financial independence and created their own currencies, exemplifying the power of paper money as a symbol of sovereignty.

- Technological Advancements: The advent of modern printing techniques and security features revolutionized the production of paper money. From the introduction of intricate watermarks to the utilization of color-shifting inks, these advancements have played a crucial role in preventing counterfeiting.

- The Digital Age: As we enter the digital age, the concept of paper currency is undergoing further transformation. With the rise of cryptocurrencies and the increasing prevalence of electronic payments, the future of paper money appears uncertain, posing questions about its place in an ever-evolving financial landscape.

The journey of paper currency is a testament to the constant evolution of human creativity and innovation. From ancient China to the digital age, the concept of representing value on paper has shaped economies and revolutionized the concept of money itself. This section delves into the intriguing history and development of paper currency, providing a fascinating glimpse into our collective financial heritage.

The Ups and Downs of Hyperinflation

Explore the tumultuous journey of hyperinflation, a phenomenon characterized by an uncontrollable increase in prices and a subsequent devaluation of currency. This section delves into the fascinating story of how hyperinflation has affected nations throughout history, examining the causes, consequences, and attempts to mitigate its impact.

1. Origins and Causes: Discover the factors that contribute to the onset of hyperinflation. Explore the economic, political, and social circumstances that can lead to a rapid depreciation of a country's currency. Gain insights into the triggers, such as excessive money supply, budget deficits, political instability, and external shocks that have historically sparked hyperinflationary crises.

2. Consequences and Effects: Delve into the devastating consequences of hyperinflation on economies and societies. Explore how hyperinflation can erode purchasing power, disrupt trade, and undermine confidence in the financial system. Examine the social implications, including skyrocketing poverty rates, social unrest, and the erosion of trust in government institutions.

3. Historical Examples: Take a journey through time as we explore notable episodes of hyperinflation in different countries. From the German hyperinflation of the 1920s to more recent examples in Zimbabwe and Venezuela, learn about the unique characteristics and impacts of each case. Investigate the policies implemented by these countries in an attempt to combat hyperinflation.

4. Lessons Learned and Mitigation: Reflect on the lessons learned from past experiences with hyperinflation and examine the strategies employed to mitigate its effects. Explore the role of central banks, fiscal policies, and international interventions in stabilizing economies during hyperinflationary crises. Gain insights into the importance of proactive measures in preventing and managing such economic turmoil.

- Dive into the macroeconomic indicators that can help predict the likelihood of hyperinflation.

- Examine the challenges nations face in recovering from hyperinflationary periods.

- Explore the debate surrounding the role of digital currencies in preventing hyperinflation.

- Discover the potential long-term consequences of hyperinflation, including its impact on savings, investments, and income distribution.

Gain a comprehensive understanding of the rise and fall of hyperinflation, from its origins to its aftermath. This section illustrates the devastating effects of hyperinflation while shedding light on the actions that can be taken to prevent and recover from such economic turmoil.

Famous Faces on Banknotes

In this section, we explore the prominent individuals whose images have been immortalized on banknotes throughout history. These remarkable personalities have left an indelible mark on the fields of politics, arts, sciences, and more, making their presence on currency a symbol of their enduring influence and legacy.

| Country | Face on Banknote |

| United States | George Washington |

| United Kingdom | Queen Elizabeth II |

| Australia | David Unaipon |

| Canada | Viola Desmond |

| South Africa | Nelson Mandela |

From iconic political leaders to renowned artists and thinkers, the faces on banknotes reflect the unique identity and values of each nation. They provide a glimpse into the rich history and cultural heritage of a country, serving as a reminder of the contributions made by these extraordinary individuals.

Beyond their symbolic significance, the presence of famous faces on banknotes also plays a role in fostering national pride and unity. It serves as a constant reminder of the achievements and progress made by a nation, encapsulated in the visage of these luminaries.

While the selection of individuals may vary across countries and time periods, their inclusion on banknotes is often a result of careful consideration and recognition of their impact on society. These faces become iconic representations, granting a sense of familiarity to the currency we handle on a daily basis.

Whether it is an inspiring political figure, a trailblazing scientist, or a renowned artist, the presence of a famous face on a banknote brings history to life and connects us to the remarkable individuals who have shaped our world.

Combatting Counterfeiting: The Fight against Counterfeit Currency

In the world of currency, there exists a persistent threat that undermines the economy and erodes public trust – counterfeit money. Counterfeiters, the illicit perpetrators behind the production and distribution of fake currency, pose a substantial challenge to governments, financial institutions, and law enforcement agencies worldwide. In this section, we will delve into the battle against counterfeit money and explore the measures taken to thwart these criminal activities.

Counterfeiters, often crafty and resourceful individuals, engage in the production and circulation of counterfeit bills, thereby compromising the integrity of national currencies. Their actions not only deceive unsuspecting individuals and businesses but also place a significant strain on economies. Governments and central banks continuously collaborate to implement strategies and technologies aimed at preventing the production and spread of counterfeit currency.

One integral aspect of the fight against counterfeit money is the development and utilization of advanced security features on banknotes. These features, meticulously designed and integrated into the production process, serve as safeguards against replication and forgery. The incorporation of intricate designs, holograms, tactile elements, and specialized inks make it increasingly difficult for counterfeiters to reproduce genuine banknotes successfully. Moreover, constant innovation in security features ensures that counterfeiters are consistently one step behind the advancements.

Another crucial component in combatting counterfeit money is the enforcement of strict legal measures. Governments enact laws and regulations that criminalize the act of counterfeiting, imposing severe penalties on those found guilty. The diligent work of law enforcement agencies, such as specialized counterfeit currency divisions, helps identify and apprehend counterfeiters, leading to their prosecution. International cooperation and information sharing among these agencies further bolster the collective effort against counterfeit money.

Education and awareness play an essential role in protecting individuals and businesses from falling victim to counterfeit money scams. Governments and financial institutions disseminate information about the characteristics and security features of genuine currency, along with advice on how to detect counterfeit bills. Initiatives such as public awareness campaigns, workshops, and educational materials aim to educate the public, empowering them to identify and report any instances of fake money.

The Role of Central Banks in Currency Production

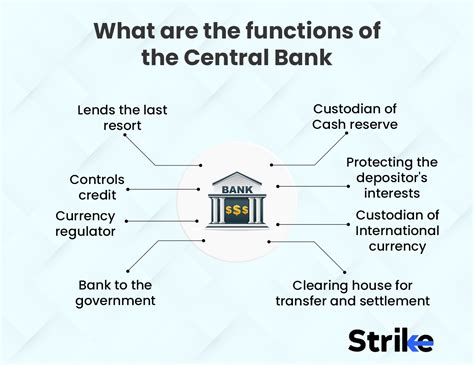

In the world of monetary systems, there exists an essential entity that plays a pivotal role in the creation and management of the medium of exchange. These institutions, known as central banks, are responsible for various crucial aspects of currency production. This section delves into the significance and functions of central banks in ensuring the smooth production and circulation of legal tender.

Digital Currency and the Future of Cash Transactions

In today's connected and technologically advanced world, the concept of money and its form of representation is undergoing a significant transformation. As traditional paper currencies face various challenges and drawbacks, the emergence of digital currency has become a potential game-changer in the financial landscape.

The Rise of Digital Currency

With the advent of digital technologies, the way we conduct transactions and exchange value has seen a notable shift. Digital currency, often referred to as virtual or electronic money, is a form of currency that exists solely in electronic or digital form. Unlike traditional paper money, it is entirely intangible, as it does not physically exist in the form of coins or banknotes.

The Advantages and Innovations of Digital Currency

One of the key advantages that digital currency brings to the table is its potential to simplify and expedite transactions. By using digital wallets and peer-to-peer networks, individuals can send and receive money in real-time, without the need for intermediaries such as banks or financial institutions.

Moreover, digital currency offers enhanced security and privacy compared to traditional cash transactions. Through the utilization of encryption techniques, digital currencies can ensure secure transactions and protect users' financial information from unauthorized access or fraud.

Furthermore, the flexibility and accessibility of digital currency make it an attractive alternative to physical cash. With digital currencies, individuals can perform transactions online or through mobile applications, providing convenience and ease of use as people no longer have to carry physical wallets or worry about counterfeit bills.

The Future of Cash Transactions

As digital currency continues to gain traction, there is a growing debate about the future of paper money and the potential demise of physical cash. Although cash still holds a significant role in many economies worldwide, the advancements in digital currency technologies and the increasing acceptance of cryptocurrencies point to a future where traditional bills and coins could become obsolete.

While there are concerns and challenges with the widespread adoption of digital currency, such as regulatory issues and potential for cyber attacks, the potential benefits that it offers in terms of efficiency, security, and convenience cannot be ignored.

In conclusion, the rise of digital currency represents a significant shift in the way we perceive and use money. As technology continues to advance, digital currency has the potential to revolutionize the financial industry, reshaping the future of cash transactions and redefining the concept of money itself.

Collecting Banknotes: An Enriching Hobby

Exploring the world of banknote collection unveils a captivating realm filled with opportunities for growth and enrichment. Beyond the traditional means of investment, delving into the realm of banknote collecting can prove to be a hobby with phenomenal returns.

Engaging in the art of banknote collecting opens up a world of historical significance, cultural exploration, and aesthetic appreciation. Each banknote tells a unique story, incorporating elements of art, design, and historical events, offering collectors a glimpse into different countries, their traditions, and their narrative. Moreover, engaging in this hobby fosters an appreciation for the craftsmanship and the intricate details involved in the production of banknotes.

Avid collectors often find themselves immersed in an exhilarating pursuit of uncovering the rarest banknotes, striving to complete sets or discover unique specimens. The excitement of chasing after a specific note, learning about its history, and sharing insights with fellow collectors creates a sense of camaraderie and connection within the hobby. Furthermore, the value of banknotes can appreciate significantly over time, making it a potentially lucrative endeavor.

| Benefits of Banknote Collection: |

|---|

| 1. Cultural exploration and historical appreciation |

| 2. Aesthetic enjoyment and appreciation for design |

| 3. Challenging quest for rare banknotes and completion of sets |

| 4. Camaraderie and connection within the collector community |

| 5. Potential financial gains |

As with any valuable collectible, it is important for banknote collectors to acquire knowledge, hone their skills, and maintain a discerning eye to ensure the quality and authenticity of their collection. By researching, attending auctions, and connecting with experienced collectors, enthusiasts can further enhance their expertise and refine their collection strategies.

In conclusion, banknote collecting offers a rewarding journey of cultural exploration, aesthetic appreciation, and potential financial gains. Beyond the allure of monetary value, this hobby enables individuals to delve into different countries' narratives and connect with a like-minded community of enthusiasts. Whether it is a quest for the rarest banknotes or a desire to appreciate the artistry involved in their creation, engaging in this hobby undoubtedly offers great returns.

FAQ

What is the article "A Dream Big Bills of Paper Money" about?

The article "A Dream Big Bills of Paper Money" discusses the concept of having large denominations of paper money, which allows for more convenience in making big purchases and transactions.

Why would anyone want larger bills of paper money?

Having larger bills of paper money can be beneficial for individuals and businesses involved in high-value transactions. It reduces the need for carrying around large amounts of cash, making transactions more convenient and secure.

Are there any countries that have already introduced big bills of paper money?

Yes, several countries have already introduced larger denominations of paper money. For example, the United States has a $100 bill, and Switzerland has a 1,000 Swiss franc note.

What are the advantages of using big bills of paper money?

The advantages of using big bills of paper money include reducing the need for carrying large amounts of cash, making transactions more convenient and secure, and reducing the cost of printing and maintaining a large number of smaller bills.

Are there any potential disadvantages of implementing big bills of paper money?

Some potential disadvantages of implementing big bills of paper money include the risk of counterfeiting, the potential for facilitating illegal activities such as money laundering, and the possible destabilization of the economy due to increased inflation.

What is the article "A Dream Big Bills of Paper Money" about?

The article "A Dream Big Bills of Paper Money" discusses the idea of creating and introducing high denomination paper bills into circulation.

Why would anyone want to create high denomination paper money?

The proponents of high denomination paper money believe that it can simplify transactions, reduce printing and transportation costs, and potentially deter illegal activities such as money laundering. They argue that it is more convenient and efficient for users who often deal with large sums of money.