In the realm of human aspirations, lies a realm of desires and aspirations that transcend the boundaries of our mortal existence. It is within these ethereal depths that dreams manifest and blend into the very fabric of our reality. However, alongside these visions of grandeur, there exists another force, a humble yet formidable opponent - dust particles.

These minuscule particles, often regarded as insignificant, have the power to infiltrate every nook and cranny of our lives. They settle undeniably on surfaces, gradually erasing the traces of our dreams and ambitions. Like a relentless force of nature, dust accumulates, the remnants of forgotten aspirations cachectically coating our path to success.

Yet, there exists another foe that relentlessly gnaws at the foundations of our dreams - the price of residences. This abstract concept, synonymous with the value one has to pay to turn dreams into tangible realities, often stands as an insurmountable barrier. The cost of housing engulfs the aspirations of many, rendering their pursuit of a dream house unattainable, anchoring them to a realm of impossibility.

Within the intricate tapestry of these seemingly unrelated elements - dreams, particles of dust, and the price of residences - lays a profound story of human existence. It is a tale of struggle, resilience, and the delicate balance between envisioning a life of meaning and encountering the ruthless realities that threaten to dismantle it. Through the intricate interplay of these forces, we find ourselves immersed in the intricate dance between illusion and veracity, aspiration and constriction.

Rising Home Costs: A Hindrance to Achieving the American Dream

In today's ever-evolving economic landscape, the escalating prices of residential properties have emerged as a formidable obstacle to the realization of the quintessential American aspiration. As the cost of owning a home continues to climb unfalteringly, individuals and families are finding themselves further distanced from the attainability of their dreams. This section delves into the far-reaching implications of skyrocketing house prices, exploring the repercussions on various aspects of the American Dream and the hurdles they present to hopeful homeowners.

1. Economic Disparities and Social Mobility

- The widening gap between house prices and income levels is fueling economic inequalities, exacerbating social divisions, and limiting upward mobility.

- Prospective homeowners, especially those from lower-income backgrounds, face mounting challenges in accumulating sufficient wealth to navigate the property market, hindering their ability to secure a stable foundation for themselves and their families.

- The rising cost of housing perpetuates a cycle of generational disadvantage, whereby the inability to invest in real estate prevents the accumulation of long-term wealth, creating lasting barriers to financial freedom.

2. Educational Opportunities and Future Prospects

- Escalating housing prices in desirable school districts impede access to quality education for families of lesser means, restricting children's opportunities for academic advancement.

- The exorbitant costs of homes near esteemed educational institutions are pricing out many aspiring students, depriving them of the chance to benefit from the transformative power of education.

- This disparity not only perpetuates educational inequality but also hinders future prospects for disadvantaged individuals, limiting avenues for personal growth, career development, and social mobility.

3. Financial Stability and Long-Term Security

- The escalating cost of homeownership necessitates larger loans, placing an additional burden on borrowers and potentially leading to increased financial vulnerability.

- Inflated house prices exert strain on already stretched budgets, diverting resources away from other essential expenses such as healthcare, education, and retirement planning.

- Moreover, the volatile nature of real estate markets can lead to precarious financial situations, as homeowners may find themselves trapped in properties with diminishing value or struggling to meet mortgage payments due to unexpected market fluctuations.

In conclusion, the soaring prices of residential properties pose a formidable barrier to achieving the American Dream. From widening economic disparities and curtailed social mobility to limited educational opportunities and compromised financial stability, the financial strain caused by escalating house prices challenges the fundamental principles upon which the American Dream is built. Addressing this issue requires collaborative efforts and innovative solutions to ensure that the American Dream remains accessible and attainable for all individuals, regardless of their socioeconomic background.

The Ripple Effect: How the Fluctuations in Residential Properties Values Affect the Economy

In this section, we will explore the far-reaching consequences of the ever-changing housing market on the overall economy. While property values may seem like a limited concern confined to the housing sector, their impact extends much further, affecting various facets of the national economy.

When residential property prices experience significant shifts, there is a domino effect that can be observed in multiple industries and sectors. The rise or fall of property values creates powerful ripples that permeate through the economy, influencing consumer behavior, investment decisions, and even the stability of financial markets.

The most noticeable impact of fluctuating house prices can be witnessed in consumer spending. As property values increase, homeowners often experience a boost in their net worth, which in turn prompts them to feel wealthier and more confident in their financial situation. This newfound confidence often leads to increased spending on goods and services, thereby stimulating economic growth. On the flip side, declining property values can have the opposite effect, causing consumers to tighten their purse strings and reduce their discretionary spending, resulting in a slowdown in economic activity.

Moreover, property prices can significantly influence investment patterns. The housing market serves as a barometer for investors, with high property prices indicating a robust and lucrative market. The attractiveness of a real estate market often lures in both domestic and foreign investors, who pour their capital into construction projects, property development, and the creation of new jobs. Conversely, when house prices fall, investors may become apprehensive, leading to a decrease in investment activity. The resulting reduced construction and development activities can lead to job losses and negatively impact the overall employment rate, thus affecting economic stability.

Furthermore, fluctuations in house prices can have implications for financial markets. Mortgage loans and residential property make up a significant portion of bank assets. Therefore, when housing prices decline, the value of these assets also decreases, potentially jeopardizing the stability of financial institutions. This situation could lead to a credit crunch, with banks becoming more cautious about lending, which can subsequently hinder consumer and business spending, further dampening economic growth.

In conclusion, the fluctuations in residential property values have far-reaching consequences beyond the housing sector. The ripple effect of these changes impacts consumer behavior, investment decisions, and financial markets, all of which converge to shape the state of the overall economy. Recognizing the interconnected nature of the housing market with other sectors is crucial in understanding and anticipating the ramifications of house price fluctuations.

The Unforeseen Expenses of Purchasing a Home: Is it Truly Worth the Investment?

When delving into the realm of homeownership, one is often captivated by the allure of fulfilling a longstanding aspiration. However, amidst the excitement of achieving this milestone, prospective buyers are frequently unaware of the numerous concealed expenses that accompany the process.

Buying a house involves far more than the initial price tag and mortgage payments. In addition to the obvious costs, there exists a plethora of unforeseen financial obligations that can significantly affect one's budget. These hidden expenses, often overshadowed by the thrill of owning property, necessitate careful consideration and evaluation.

Among the concealed costs are the considerable expenditures associated with property maintenance and repairs. Owning a house demands regular upkeep, such as landscaping, painting, and other maintenance tasks, which, over time, can accumulate into a substantial financial burden.

Moreover, homeowners are frequently confronted with unanticipated dilemmas, such as unexpected repairs or damage caused by natural disasters. These unpredicted expenses can strain one's financial resources, requiring immediate attention and substantial financial inputs.

Another aspect that tends to be overlooked is the expenditure associated with insurance and property taxes. Homeowners are required to possess adequate insurance coverage to protect their property from any potential hazards, and this, combined with property taxes, contributes to the overall cost of homeownership.

Furthermore, the location of the property plays a pivotal role in determining the hidden costs. Areas with higher housing prices generally entail increased property taxes, insurance rates, and maintenance expenses. Thus, it is crucial for prospective homeowners to thoroughly research and analyze various locations to ensure they are well-informed of the potential financial implications.

While the dream of owning a house may be enticing, it is imperative not to overlook the hidden costs that can emerge during the homeownership journey. Understanding the true financial commitment associated with purchasing a home is essential in making an informed decision and determining whether the investment is truly worthwhile in the long run.

Dust in the Wind: Exploring the Environmental Impact of Soaring Residential Property Costs

As urban housing costs continue to escalate, it becomes imperative to examine the broader consequences beyond financial burdens. This section delves into the environmental implications associated with the relentless rise in residential real estate prices, shedding light on the ecological ramifications that often go unnoticed.

From Boom to Bust: Understanding the Cyclical Nature of Residential Property Costs

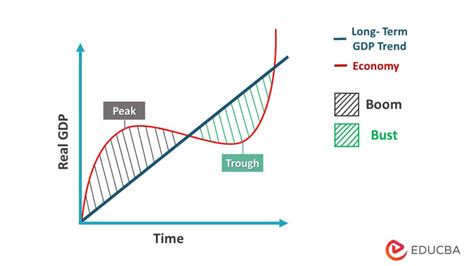

In the dynamic world of residential real estate, the value of properties is subject to a cyclical pattern that influences their prices. This article explores the intricate nature of these cycles, shedding light on the phenomenon of real estate markets gradually shifting from periods of prosperity to downturns, commonly referred to as booms and busts.

The Booms: During periods of economic growth and stability, the residential property market experiences a boom. Demand for housing spikes, leading to rising prices and a surge in construction activity as developers strive to meet the high market demand. Property owners, investors, and developers witness an upswing in property values and sales, often reaping substantial financial rewards. This upward momentum may be driven by factors such as low interest rates, job growth, population expansion, and consumer confidence.

For instance, the property market may witness an upswing, where housing prices soar, bidding wars become the norm, and homeownership becomes increasingly difficult for aspiring buyers to attain.

The Busts: The euphoria of a booming real estate market is often followed by a period known as a bust. During this downturn phase, property prices decline, sales stagnate, and construction activity levels drop as demand diminishes. The once-thriving market sentiment turns sour, leaving property owners and investors facing the challenge of selling properties at lower prices or holding onto them until conditions improve.

As the market corrects itself, housing prices may plummet, causing distress for homeowners who experience negative equity and potential financial instability.

Understanding the cyclical nature of house prices is crucial for homeowners, investors, policymakers, and real estate professionals. By recognizing the presence of these cycles, individuals can better navigate the ever-changing landscape of the residential property market and make informed decisions regarding buying, selling, or investing in real estate.

The impact of governmental measures on achieving housing affordability

Government policies play a crucial role in mitigating the challenges associated with the cost of residential properties, striving to strike a balance between the purchasing power of individuals and the overall economic stability. This section delves into the significance of governmental interventions in shaping the housing market.

Housing Market Disparities: Bridging the Gap Between Urban and Rural Areas

As we delve into the complex world of housing markets, it becomes evident that there is a stark contrast between the urban and rural areas. This divide goes beyond mere geographical distinctions - it refers to the significant differences in housing conditions, affordability, and availability.

In urban areas, the housing market is characterized by soaring prices, escalating demand, and limited space. The urban dream of a spacious home with all amenities within easy reach often comes with a hefty price tag. The cost of urban accommodation poses a challenge for many aspiring homeowners, particularly those with modest incomes. As a result, urban housing becomes a luxury that not everyone can afford.

On the other hand, rural areas present a different set of circumstances. Housing options in rural regions tend to be more affordable and offer greater potential for land ownership. However, limited access to infrastructure, amenities, and job opportunities may deter individuals from settling in rural areas. The dream of a quiet countryside home may lose its allure if it means sacrificing convenience and economic prospects.

Bridge the divide between urban and rural housing markets is essential in ensuring equitable accessibility to affordable and adequate housing for all. Employing innovative policies that promote urban development without compromising rural charm can bring about positive changes. Affordable housing initiatives, infrastructure improvements, and investment in rural communities can help make rural areas more attractive to potential residents.

In conclusion, it is crucial to acknowledge the disparities in the housing market between urban and rural areas. By addressing the challenges faced by both sides, we can strive towards a more inclusive housing market that caters to the diverse needs and aspirations of individuals across all regions.

Generation Rent: The Impact of Soaring Property Costs on Millennials

As the younger generation continues to grapple with the soaring prices of real estate, the dream of homeownership seems distant and almost out of reach for many millennials. This article explores the profound effects of skyrocketing property costs on the lives of young adults, highlighting the challenges they face in the current housing market.

One key aspect affected by exorbitant property prices is the concept of financial stability. With limited disposable income due to high rent and the inability to save for a down payment, millennials find themselves caught in a cycle of renting, unable to build equity or establish a solid foundation for their financial future.

Add to this the psychological impact of this predicament. Millennials often experience feelings of frustration and discouragement as they witness their dreams of homeownership being replaced by the harsh reality of renting. The sense of security and pride associated with owning a home is replaced by a sense of transience and uncertainty as they are forced to switch residences frequently.

| Challenges Faced by Millennials: |

|---|

| Limited affordability and high rent |

| Inability to save for a down payment |

| Increased financial instability |

| Emotional impact of deferred homeownership |

| Transience and lack of security |

Furthermore, the ripple effects of these housing challenges extend beyond individual millennials. The increasing trend of "Generation Rent" has broader economic implications such as limited spending power, reduced investment opportunities, and hindered social mobility. This trend has the potential to reshape societal dynamics, as the dream of property ownership becomes an unattainable reality for an entire generation.

In conclusion, the impact of soaring property costs on millennials cannot be overstated. It not only affects their financial stability but also takes a toll on their emotional well-being and societal prospects. Urgent measures are needed to address this issue, ensuring that the dream of homeownership remains within reach for the younger generation.

Investing in the Dream: Real Estate as a Path to Accumulating Wealth

Within the realm of wealth accumulation, there exists a time-tested avenue that promises substantial returns and a tangible representation of prosperity: real estate investment. By strategically engaging in the purchase, ownership, and management of properties, individuals have the opportunity to secure their financial future and attain the lifestyle they desire.

Real estate, as an investment vehicle, offers distinct advantages that set it apart from other forms of wealth-building endeavors. Unlike volatile markets or fluctuating stock prices, properties possess an inherent stability that withstands the test of time. This tangible asset provides security and potential appreciation, making it an attractive option for those seeking an enduring avenue for wealth accumulation.

Investing in real estate is a pathway towards diversifying one's assets, reducing dependency on other financial instruments, and minimizing risk. By expanding investment portfolios to include properties, individuals can safeguard their wealth against economic downturns and achieve long-term financial stability.

- Real estate investment provides individuals with the opportunity to generate passive income through rental properties. By acquiring income-generating assets, investors can establish a steady stream of cash flow, creating a reliable source of revenue.

- Properties offer unique tax advantages, whereby certain expenses related to owning and managing real estate can be deducted, reducing the tax burden for investors. This financial incentive further enhances the viability of real estate as a means of wealth accumulation.

- Additionally, owning real estate grants individuals the ability to leverage their investment through mortgage financing, multiplying their purchasing power and maximizing returns. This leverage allows investors to acquire properties that they may not have been able to afford outright, thereby increasing their potential for wealth accumulation.

- Moreover, as populations grow and urban centers expand, the demand for housing continues to rise, driving the appreciation of property values. This phenomenon further augments the potential for capital gains in real estate investment, providing an opportunity for substantial wealth accumulation.

In conclusion, real estate investment presents itself as a compelling avenue for individuals seeking to accumulate wealth. Through its stability, significant tax advantages, potential for passive income, and opportunities for leveraging, real estate offers a long-term strategy for diversifying assets and securing financial prosperity.

Thinking Outside the Box: Finding Affordable Housing Alternatives

Exploring innovative pathways to homeownership and addressing the escalating costs associated with traditional housing options, this section delves into alternative solutions that break free from the constraints of high prices, offering individuals and families greater accessibility to affordable homes.

Embracing Creative Approaches: By thinking beyond conventional dwellings, individuals and communities can embrace unique and progressive housing options that challenge the status quo. These solutions prioritize sustainability, efficiency, and affordability, paving the way for new possibilities in the quest for suitable and cost-effective housing.

The Rise of Tiny Homes: A popular trend gaining traction in recent years, tiny homes present a viable alternative for those seeking simplicity, mobility, and reduced expenses. These compact spaces offer a minimalistic lifestyle without compromising comfort, exemplifying the potential for affordable housing through innovative design and resource optimization.

Shared Living and Co-housing: Another alternative gaining popularity is the concept of shared living spaces and co-housing. By pooling resources and sharing costs, individuals can create cooperative communities that provide affordable housing options, fostering a strong sense of community, and promoting social connections.

Repurposing and Renovation: Transforming existing structures and repurposing underutilized spaces can offer an alternative solution to expensive house prices. Renovation projects and adaptive reuse allow for the preservation of architectural heritage while offering affordable housing options that cater to the needs and preferences of diverse communities.

Exploring Collaborative Financial Models: In addition to creative housing options, exploring innovative financial models can help individuals overcome the obstacles posed by high house prices. Shared equity schemes, rent-to-own programs, and community land trusts are just a few examples of collaborative approaches that empower individuals to realize their dream of homeownership.

By breaking away from the conventional notions of homeownership, these alternative housing solutions open doors for individuals to achieve their housing goals without succumbing to the burden of exorbitant prices, fostering a more sustainable and inclusive housing market for all.

FAQ

What is the article "A Dream, Dust, and the Cost of House Prices" about?

The article "A Dream, Dust, and the Cost of House Prices" discusses the impact of high house prices on people's dreams of homeownership and the challenges they face in achieving that dream.

Why are house prices a concern for many people?

House prices are a concern for many people because they have been steadily increasing, making it difficult for them to afford a home. This creates a sense of frustration and disappointment for those who are unable to enter the housing market.

What are some reasons behind the rising cost of house prices?

The rising cost of house prices can be attributed to factors such as limited housing supply, high demand, and low interest rates, which stimulate demand. Additionally, speculation and investments in real estate also drive up prices.

How does the high cost of house prices affect people's lives?

The high cost of house prices affects people's lives in various ways. It can lead to financial stress, as individuals and families struggle to save enough money for a down payment or afford mortgage payments. It can also force people to live in less desirable areas or have longer commutes to work.

Are there any potential solutions to the issue of high house prices?

There are several potential solutions to the issue of high house prices. These include increasing housing supply through construction and zoning reforms, implementing stricter regulations on real estate speculation, and providing financial assistance or incentives for first-time homebuyers.

What is the article "A Dream, Dust, and the Cost of House Prices" about?

The article "A Dream, Dust, and the Cost of House Prices" discusses the impact of rising house prices on people's dreams of homeownership and the challenges it poses to affordable housing.

Why are house prices increasing?

House prices are increasing due to various factors, such as increased demand, low interest rates, limited housing supply, and speculative investment in the real estate market.