In the realm of ideas and concepts, where thoughts intertwine and imaginations roam freely, there exists a vision so profound, so compelling, that it captivates the minds of countless souls. This vision transcends the boundaries of ordinary perception, beckoning individuals from all walks of life to delve into a realm of knowledge that is both awe-inspiring and perplexing. Within this ethereal realm, a sacred place emerges, where a congregation of seekers embarks on a journey of epiphany and enlightenment.

As the mind wanders through the labyrinth of possibilities, weaving narratives and uncovering hidden truths that lie dormant in the depths of consciousness, the essence of this vision becomes evident. It is not merely a quest for knowledge, but a cornerstone of a profound transformation that intertwines the fabric of existence itself. It is a testament to the ceaseless curiosity and unyielding resolve of the human spirit, forever yearning for understanding amidst the vast tapestry of life's intricacies.

Within this sacred place, the amalgamation of intellects forms an orchestra of ideas, harmonizing with the symphony of knowledge. Each individual, with their unique perspectives and insights, brings forth a fragment of wisdom that collectively creates a mosaic of revelations. Through a dance of collaboration and intellectual discourse, the barriers of ignorance crumble, and the pursuit of truth takes flight.

And what is the crux of this wondrous vision? It is an enigmatic revelation that revolves around the delicate balance of costs and value, the fine thread that weaves itself into every fabric of human existence. Like a riddle waiting to be solved, this revelation teases the intellect, challenging the mind to decipher the intricacies of economic dynamics and the mysteries of pricing mechanisms. It is a revelation that holds within it the power to alter perceptions, to shape industries, and to redefine the very essence of human interaction.

A Church Awakening: Unraveling the Enigmatic World of Price Discovery

In this section, we delve into the fascinating realm of deciphering the intricate process of price discovery. As we explore the mysteries surrounding the determination of prices, we aim to shed light on how various factors and participants converge to uncover the true value of goods and services.

The Multifaceted Nature of Price Discovery Unlocking the hidden secrets of price discovery requires an understanding of its complex nature. It is a dynamic process that involves a multitude of actors, ranging from buyers and sellers to market makers and speculators. The interplay of supply and demand, along with various external factors, contributes to the enigmatic world of price discovery. |

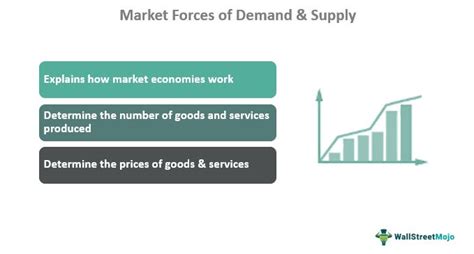

Market Forces: Catalysts of Price Discovery Market forces act as the driving mechanism behind the revelation of prices. Supply and demand dynamics, influenced by factors such as production costs, consumer preferences, and economic conditions, construct the foundation upon which price discovery is built. By analyzing these forces and their impact on pricing, we gain insights into the underlying mechanisms that shape the market. |

The Role of Participants in Price Discovery Price discovery is a collaborative effort, involving a multitude of participants with distinct roles. Market makers provide liquidity and facilitate the efficient flow of transactions, while speculators bring their insights and judgments to the table, influencing market sentiment. Understanding the contributions of these participants will help us unravel the mysteries behind the accurate determination of prices. |

The Impact of Information on Price Discovery Information plays a pivotal role in the process of price discovery. Market participants rely on various sources to gather insights and make informed decisions. News, economic data, and market sentiment all contribute to the information flow that influences price discovery. Examining the relationship between information and price formation provides a deeper understanding of how prices are unveiled. |

From Perplexity to Understanding: Decoding Price Fluctuations

In this section, we embark on a journey that aims to unravel the enigmatic nature of price movements, shedding light on the underlying factors that drive them. We delve into the complexities of market dynamics, exploring the intricate patterns and forces at play when it comes to pricing.

By closely examining the interplay between supply and demand, we aim to demystify the seemingly erratic nature of price fluctuations. Through a careful analysis of various market indicators and trends, we uncover the intricate web of factors that influence prices, allowing us to construct a comprehensive understanding of their movements.

Using a holistic approach, we dissect the fundamental drivers of price changes, exploring the impact of factors such as consumer behavior, economic conditions, and market competition. Through an in-depth examination of these elements, we aim to establish a framework that enables individuals and businesses to navigate the complexities of price movements with clarity and confidence.

| Key Topics Covered in this Section: |

|---|

| 1. The role of supply and demand in price fluctuations |

| 2. Understanding the influence of consumer behavior on pricing |

| 3. Analyzing economic conditions and their impact on prices |

| 4. Unveiling the role of market competition in pricing dynamics |

The Role of Supply and Demand: Exploring the Forces that Shape the Market

Within the realm of commerce, a delicate dance occurs between the forces of supply and demand. These dynamic market forces intertwine to dictate the prices of goods and services, exerting their influence on the economic landscape. Understanding the role of supply and demand is crucial for individuals and businesses alike, as it allows them to make informed decisions and adapt to the ever-changing market conditions.

| Supply | Demand |

| Availability | Desire |

| Cost of production | Consumer purchasing power |

| Competition | Trends and preferences |

At its core, supply refers to the quantity of a particular good or service that producers are willing and able to offer in the market. It is influenced by factors such as the availability of resources, the cost of production, and the level of competition within the industry. On the other hand, demand represents the desire and purchasing power of consumers for the same goods or services. It is influenced by factors such as consumer preferences, economic trends, and overall consumer income.

When supply and demand interact, they determine the equilibrium price and quantity of a product. In a competitive market, where supply and demand are balanced, the price settles at a level where the quantity supplied equals the quantity demanded. This price is often referred to as the market-clearing price. However, if the supply exceeds the demand, prices tend to decrease, whereas if the demand exceeds the supply, prices tend to increase.

The concept of supply and demand is not limited to individual products or services but extends to entire industries and economies. Governments and businesses closely monitor these market forces to assess economic conditions, make pricing decisions, and plan for future growth. By understanding the intricate relationship between supply and demand, individuals can navigate the complexities of the market and adapt their strategies to thrive in an ever-evolving business environment.

The Invisible Hand at Work: Exploring Adam Smith's Theory of Price

In this section, we delve into the concept of the unseen force that governs economic transactions, as postulated by the renowned economist Adam Smith. By examining Smith's theory of price, we gain insights into the intricate workings of the market and the factors influencing price determination.

Adam Smith's theory posits that prices in an economy are not arbitrarily set, but instead are influenced by a complex interplay of supply and demand. The concept of the "invisible hand" refers to the guiding force that ensures equilibrium between supply and demand, leading to the establishment of market prices.

To understand this phenomenon, we can visualize the market as a dynamic ecosystem, where individual economic agents interact through buying and selling goods and services. These interactions, driven by self-interest, result in a constantly evolving equilibrium where supply meets demand.

| Supply | Demand | Equilibrium Price |

| Producers offer goods | Consumers desire goods | Price determined at the intersection of supply and demand |

The invisible hand theory suggests that as individuals pursue their own self-interest, they unintentionally promote the well-being of the entire economy. When suppliers recognize high demand for their goods, they are incentivized to increase production, leading to a surplus. As a result, prices are driven down until the market reaches a new equilibrium.

Conversely, when demand dwindles, suppliers reduce production, resulting in scarcity and higher prices. This process of constant adjustments ensures the market remains in a state of balance, as the invisible hand guides prices towards their optimal point of intersection between supply and demand.

Understanding Adam Smith's theory of price provides valuable insights into the dynamics of the market and highlights the importance of individual economic decisions on the overall functioning of the economy. By appreciating the role of the invisible hand, we gain a deeper understanding of the mechanisms that determine prices and how they impact various stakeholders within an economy.

Behind the Curtain: Understanding Price Manipulation and its Consequences

The Enigmatic Depths of Price Manipulation: A Journey to Uncover its Secrets

Price manipulation, a clandestine dance masked by deceptive tactics, possesses a profound impact on global markets. This captivating exploration delves into the intricate web of price manipulation, unraveling its enigmatic motives and shedding light on the consequences it bestows upon economies and individuals alike.

Delving into Dark Waters

In the shadows of economic landscapes lie those who wield power and knowledge to manipulate prices, orchestrating a delicate symphony to sway markets and serve their own interests. This section plunges into the murky depths of price manipulation, exploring the clandestine techniques utilized by cunning actors to wield influence over market forces.

The Puppeteers and their Mastery

Behind the curtain of price manipulation stand those who possess an intricate understanding of market dynamics and possess the ability to tamper with prices at will. Unveiling the masters of this art, this section dissects their strategies, from spreading false information to artificially inflating or deflating prices, exposing the deceitful methods employed to exploit market vulnerabilities.

The Ripple Effect: Consequences on Global Economies

Price manipulation creates a ripple effect that reverberates through global economies, leaving a trail of consequences in its wake. This segment uncovers the far-reaching impact of manipulated prices, from distorting supply and demand dynamics to stunting economic growth and exacerbating income inequality. The consequences extend beyond mere numbers, affecting the lives and livelihoods of individuals and businesses around the world.

Building a Shield: Safeguarding Against Manipulation

As knowledge of price manipulation deepens, so does the urgency to create robust measures to safeguard against its detrimental effects. This section emphasizes the need for regulatory frameworks, transparency, and accountability to fortify markets against manipulation. Exploring the role of governments, financial institutions, and individuals, it offers insights into building a shield that defends against price manipulation's pernicious influence.

Emerging Trends and Future Perspectives

As the world evolves, so too does the landscape of price manipulation. This final section examines emerging trends in techniques and technologies, such as algorithmic trading and cryptocurrency, shedding light on their potential susceptibility to manipulation. It concludes with a glimpse into the future, highlighting the importance of continued vigilance and proactive measures to mitigate the impact of price manipulation.

The Value of Time: Examining the Connection between Interest Rates and Inflation

In the realm of economic dynamics, the intricate relationship between interest rates and inflation has long captivated the attention of scholars and policymakers alike. By delving deep into this complex connection, we can uncover valuable insights into the impact of fluctuating interest rates on the prevailing levels of inflation. This article aims to explore the interplay between interest rates and inflation, shedding light on the crucial role that time plays in shaping these two fundamental factors of the economy.

The Dance of Interest Rates and Inflation

Interest rates, often viewed as the cost of borrowing or the reward for saving, hold immense power over both individuals and businesses. They influence investment decisions, consumption patterns, and overall economic growth. Similarly, inflation, the steady rise in prices of goods and services over time, affects the purchasing power of individuals and the stability of markets. Understanding the intricate dance between these two forces is crucial for forecasting economic trends and making informed policy decisions.

Time as the Catalyst

Time stands as a vital catalyst in the relationship between interest rates and inflation. It acts as a conduit through which the effects of changing interest rates propagate across the economy, ultimately influencing the rate of inflation. Exploring the impact of time on this relationship unveils the intricate mechanisms that shape the dynamics of borrowing, lending, and spending, providing key insights into the overall health of the economy.

The Role of Central Banks

Central banks, as the custodians of monetary policy, hold the power to influence interest rates and inflation. Through the manipulation of key rates, such as the benchmark interest rate, central banks employ various tools to steer the economy towards desirable levels of growth and price stability. Understanding how central bank actions impact interest rates and, consequently, inflation, is crucial for comprehending the larger economic landscape.

Analyzing Historical Trends

By analyzing historical data and trends, economists can glean valuable insights into the relationship between interest rates and inflation. Examining past periods of economic expansion and contraction allows us to identify patterns and correlations, offering a deeper understanding of the factors driving inflation rates and the corresponding impact on interest rates. Such historical analysis serves as a guide for shaping future monetary policies and mitigating potential economic risks.

In conclusion, understanding the intricate connection between interest rates and inflation necessitates a comprehensive analysis of historical trends, the role of time as a catalyst, and the actions of central banks. By delving into these factors, policymakers and economists can gain valuable insights into the broader economic landscape, allowing for informed decision-making and the promotion of stable economic growth.

The Cost of Progress: Analyzing the Impact of Technological Advancements on Price Dynamics

In this section, we delve into the intriguing correlation between technological advancements and changes in prices. As society continues to embrace new technologies and innovative solutions, it is essential to evaluate how these advancements affect the cost of goods and services. Through careful analysis and examination, we seek to uncover the intricate relationship between progress and pricing.

The Global Puzzle: Exploring International Factors Impacting Price Fluctuations

In the world of economics, prices are influenced by a multitude of factors that extend far beyond national borders. To gain a comprehensive understanding of the dynamics of prices, it is crucial to investigate the various international elements that play a role in shaping market trends. This section delves into the intricate puzzle of global interactions and their impact on pricing, offering insights into the complexities of the international marketplace.

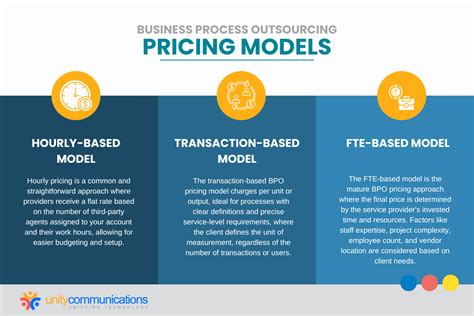

Hidden Treasures: Exploring Alternative Pricing Models

In this section, we delve into the realm of unconventional and innovative pricing models that have been discovered by ingenious thinkers in various industries. These hidden gems challenge traditional approaches to pricing and offer new insights into how businesses can maximize their profits while providing unique value to their customers.

One of the remarkable alternative pricing models is the "Pay What You Want" strategy, where customers have the freedom to set the price for a product or service based on their perceived value. This approach not only fosters trust and transparency but also allows businesses to tap into the customer's willingness to pay more when they feel strongly connected to the brand or when they perceive exceptional value.

Another unconventional pricing model gaining traction is the subscription-based model, which provides customers access to a range of goods or services for a fixed recurring fee. This model creates a predictable revenue stream for businesses while offering customers convenience, flexibility, and the opportunity to enjoy a variety of offerings without the burden of ownership.

Furthermore, dynamic pricing, also known as surge pricing, is another intriguing model being adopted by businesses. This strategy adjusts prices according to demand, allowing businesses to optimize revenue during peak times and encourage customers to make purchases during off-peak periods by offering attractive discounts. This model not only enables businesses to achieve pricing elasticity but also enhances customer satisfaction by aligning prices with perceived value.

Additionally, value-based pricing, a strategy where prices are based on the perceived value of the product or service to the customer, rather than on production costs or market competition, has gained popularity in recent years. By understanding the specific needs and preferences of their target audience, businesses can effectively communicate the unique value proposition of their offerings and can justify higher prices based on the benefits derived by the customers.

In conclusion, exploring alternative pricing models presents businesses with opportunities to differentiate themselves in the market, better serve their customers, and potentially increase their profitability. By breaking away from conventional pricing approaches, businesses can unlock hidden treasures and discover new ways to delight their customers while optimizing their revenue streams.

The Cost of Ignorance: Exploring the Hazards of Misinterpreting Market Trends

Underestimating the significance of grasping market trends can lead to serious consequences in various financial spheres. This section delves into the perils that arise from the lack of knowledge and understanding when it comes to correctly assessing market fluctuations and making informed decisions.

Forging a New Path: Unveiling Strategies for Navigating Volatile Price Fluctuations

In this section, we explore innovative approaches to successfully navigate through the challenges posed by unpredictable and ever-changing price fluctuations. By introducing groundbreaking strategies and techniques, this discussion aims to empower individuals and businesses alike in forging a new path towards stability and profitability.

Amidst the dynamic nature of market conditions, it becomes essential to adopt resilient measures capable of mitigating the adverse effects brought about by volatile price fluctuations. As we delve deeper into this topic, we will uncover practical insights and best practices that can help individuals and organizations navigate through this intricate landscape with confidence and adaptability.

Developing a strategic mindset: Cultivating a forward-thinking mindset is a key aspect of managing price fluctuations. This involves constantly monitoring various factors that influence prices, such as supply and demand dynamics, market trends, geopolitical influences, and economic indicators. By staying informed and anticipating potential changes, individuals can proactively adjust their strategies and position themselves to capitalize on emerging opportunities.

Implementing risk management measures: Volatile price fluctuations inherently carry risks, and implementing effective risk management measures is vital for ensuring stability and safeguarding against potential losses. These measures can include diversifying portfolios, hedging strategies, and establishing solid contingency plans. By meticulously assessing and managing risks, individuals can significantly minimize the impact of price fluctuations on their finances and overall business performance.

Embracing technological advancements: The emergence of advanced technologies has revolutionized how individuals navigate price fluctuations. Automated trading systems, sophisticated algorithms, and predictive analytics tools offer a wealth of opportunities to optimize decision-making processes. By leveraging these technological advancements, individuals can access real-time data, make informed choices, and take advantage of price fluctuations in a timely and efficient manner.

Continuous learning and adaptation: In a world where financial markets are constantly evolving, individuals must embrace a philosophy of lifelong learning and adaptability. By staying abreast of industry developments, innovations, and evolving trends, individuals can continually refine their strategies and remain agile in the face of price fluctuations. This commitment to learning ensures that individuals are equipped with the latest tools and knowledge to navigate the ever-changing landscape effectively.

By implementing forward-looking strategies, embracing technological advancements, and fostering a mindset of adaptability, individuals can overcome the challenges posed by volatile price fluctuations and find new opportunities for growth and success in the ever-evolving market.

FAQ

What is the article "A Dream of a Church and Numerous Individuals Unveiling a Mystifying Revelation on Prices" about?

The article is about a unique collaboration between a church and individuals that resulted in the discovery of a mysterious revelation about prices.

How did the collaboration between the church and individuals come about?

The collaboration between the church and individuals came about through a shared interest in understanding the dynamics of pricing and its impact on society.

What was the nature of the mysterious revelation on prices?

The mysterious revelation on prices revealed a hidden pattern that explained the fluctuations in prices and provided insights into the underlying factors influencing them.